In sickness and in wealth – opportunities in health care for active investors

It’s a sector that accounts for 9% of global GDP, and uniquely will be used by everyone at some point in their lives. And as the population ages and technology advances, health care is set to become one of the most interesting arenas for stock pickers, says analyst Alyssa Cornuz.

概要

- Health care to benefit from aging and rising burden of chronic conditions

- Pipelines remain crucial for profits but patent cliffs hamper progress

- AI is assisting development of new cures as digitalization trends grow

Spending on health care in the US alone reached USD 4.5 trillion in 2023, an amount greater than the GDP of Japan. Priorities within the sector have changed since the Covid pandemic, though it remains the ultimate long-term theme as the global population gets older and sicker.

“Globally, several structural factors are driving this trend, including an aging population, with projections indicating that by 2050, one in every six individuals worldwide will be over 65, compared with one in 11 currently,” says Cornuz, healthy living analyst with Robeco’s thematic equity team.

“Then there is the rising burden of chronic conditions, such as cardiovascular diseases, cancer or diabetes, and increased demand for health care services in emerging markets. This provides an opportunity for investors to discover companies that can apply new AI technologies, develop new cures, and improve the effectiveness of health care spending generally.”

“However, there remain some challenging headwinds, including reduced revenues for health care suppliers post-Covid, drug price controls, and regulatory uncertainty; rebates for Medicare in the US created a challenging backdrop for parts of the sector in 2023.”

“On top of that, the launch of GLP-1 drugs for obesity led to massive dispersion in performance between Big Pharma, MedTech and other health care sub-sectors. While more dispersion and macro uncertainty are likely in 2024, this provides the active stock picker with more opportunities than seen in recent years, with valuation support and more divergence between winners and losers.”

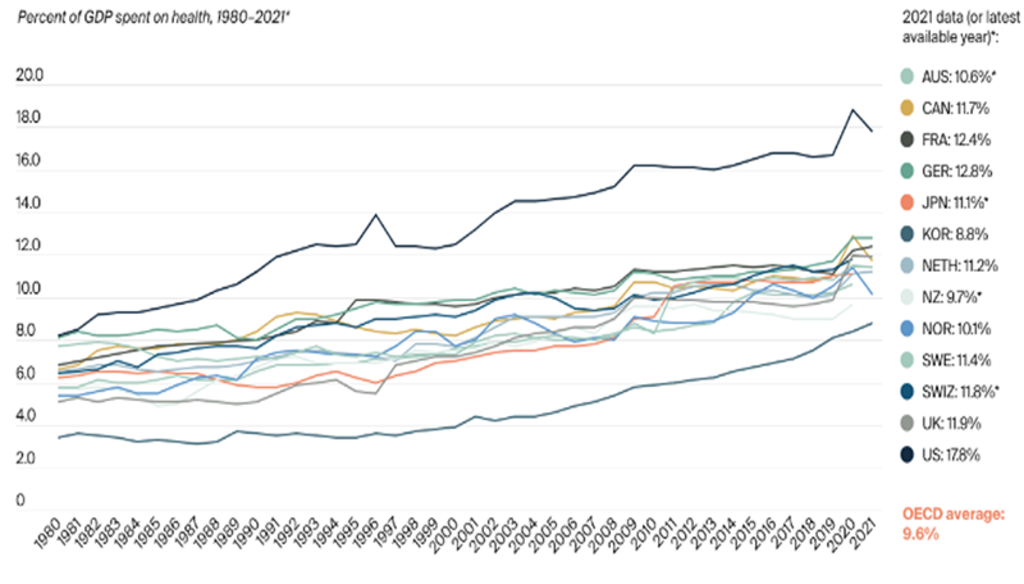

The percentage of GDP spent on health care; the US leads the pack at 17.8%.

Source: Morgan Stanley

Cornuz says three factors stand out, led by recovery in the biotech and life sciences sectors, the prospect of no upsets in the upcoming US Presidential and Congressional elections, and a refocus on attractive therapeutic areas beyond GLP-1.

“M&A activity in biotech has seen a pick-up in the year to date that is likely to persist, albeit with a shift towards acquiring later-stage assets, as Big Pharma replenishes its pipelines,” she says.

“Health care is not expected to be a central theme in the US elections. Although large cap pharma and managed care remain exposed to headwinds such as repeal of the Affordable Care Act, other sub-sectors such as life sciences tools or contract research organizations (CROs) or contract manufacturing organizations (CMOs) involved in making new drugs should remain insulated.”

“Finally, the market focus is moving past drugs for obesity to other product cycles such as tackling Alzheimer’s disease or developing respiratory vaccines.”

Pipelines, patents and profits

Cornuz says the pipeline of new drugs underpins growth in the sector, particularly as patents expire for blockbuster products. Patents provide immunity from competition while they are active, making them into de facto monopolies, but other companies can manufacture the same product once they expire.

“The race to discover a Covid-19 vaccine put a spotlight on the industry’s ability to rapidly innovate, but the patent cliff is always a drag on Big Pharma that is set to cost the industry USD 180 billion in lost revenue by the end of the decade,” Cornuz says.

“So, building on the acceleration of innovation through faster product cycles or M&A is a key theme for the sector. Notable therapeutic areas offering growth opportunities include oncology, immunology, diabetes/obesity, and neurology, particularly for tackling Alzheimer's disease.”

AI lends a helping hand

Pipelines are a risky business, since developing a new drug typically takes eight to ten years and costs USD 1-2 billion per product, with only one out of every ten candidates ever reaching the market with regulatory approval. So, can artificial intelligence help?

“AI has the potential to shorten product development by contributing to faster drug discovery and the reduction of clinical trial failure rates,” Cornuz says. “With data integration, trend recognition and predictive modeling, AI can speed up the understanding of diseases and help to identify future winners in the traditional drug discovery process, while machine learning algorithms can optimize clinical trial designs.”

“Beyond drug development, data-driven digital health care tools have the potential to improve patient outcomes while reducing inefficiencies. In a sector plagued with shortages of skilled labour, AI can help facilitate patient care from pre-appointment to diagnostics, and reduce hospitals’ administrative burdens.”

Spending on digitalization

Digitalizing the sector – the subject of a past engagement theme at Robeco – is also both a long-term cost and opportunity for a sector that relies on accurate medical records and the ability to track the effectiveness of doctors’ prescriptions. Investments in digital health totalled USD 45 billion during the pandemic, ranging from clinical trials technology to home health and wellness.

“From 2020-2022, health care was the sector with the highest capital invested in AI after IT,” Cornuz says. “Funding since the pandemic ended has steeply declined, pressured by rising interest rates.”

“The headwinds facing the sector are well understood; what is not is how investments in digital and AI tools are providing clear productivity gains. That is yet to come, and will be an issue for investors to consider in this vibrant but always challenging sector.”

獲取最新市場觀點

訂閱我們的電子報,時刻把握投資資訊和專家分析。

Important information

The contents of this document have not been reviewed by the Securities and Futures Commission ("SFC") in Hong Kong. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice. This document has been distributed by Robeco Hong Kong Limited (‘Robeco’). Robeco is regulated by the SFC in Hong Kong. This document has been prepared on a confidential basis solely for the recipient and is for information purposes only. Any reproduction or distribution of this documentation, in whole or in part, or the disclosure of its contents, without the prior written consent of Robeco, is prohibited. By accepting this documentation, the recipient agrees to the foregoing This document is intended to provide the reader with information on Robeco’s specific capabilities, but does not constitute a recommendation to buy or sell certain securities or investment products. Investment decisions should only be based on the relevant prospectus and on thorough financial, fiscal and legal advice. Please refer to the relevant offering documents for details including the risk factors before making any investment decisions. The contents of this document are based upon sources of information believed to be reliable. This document is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. Investment Involves risks. Historical returns are provided for illustrative purposes only and do not necessarily reflect Robeco’s expectations for the future. The value of your investments may fluctuate. Past performance is no indication of current or future performance.