Investigating the link between ESG and investment performance

Half a century of academic research finds that in most cases, companies that apply ESG principles tend to be higher quality and financially superior. Curiously, results are less robust for investment portfolios. We look at possible resolutions to this conundrum and also explain why our convictions on ESG and investments are as strong as ever.

Summary

- Research shows a positive link between ESG and company financials

- Results less conclusive for investment portfolios

- For some investors, performance is about more than returns

The link between sustainability and company financial performance has been grounded in half a century of academic research. A 2015 meta-study from Friede et al. undertook an exhaustive, quantitative study of the entire universe of 2,250 published academic studies on ESG performance spanning four decades of data from 1970 to 2014. 1

The analysis concluded that ESG correlated positively to corporate financial performance in 62.6% of studies and produced negative results in less than 10% of cases (the remainder were neutral). A 2023 study analyzed company performance from 2015 to 2020. The results were similar, supporting the notion that integrating ESG information into corporate operations and decision-making may add value that translates to better managed companies and better corporate financial performance.2

ESG performance and investment performance

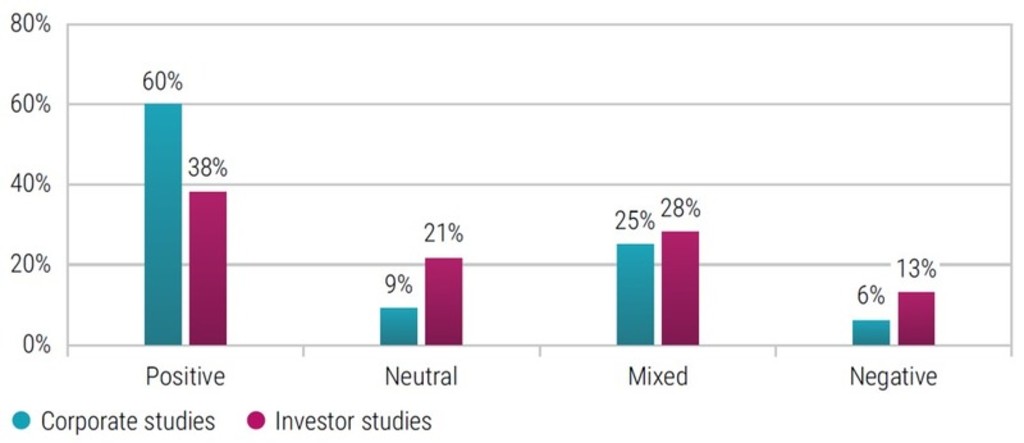

Intuitively, what works for individual companies should also work for investment portfolios. However, while still positive, the link between ESG and overall portfolio returns was less robust. Sustainability data positively influenced portfolio returns in 38% of cases, while a negative influence was found only 13% of the time (see Figure 1). More strikingly, based on portfolio returns at the aggregate, researchers concluded that ESG investing has on average been indistinguishable from non-ESG investing.3 What’s more, other highly influential papers have shown that employing sustainable investing approaches such as exclusions to avoid certain types of stocks (e.g., ‘sin stocks’) actually sacrificed returns.4How can the impact of something that works so well for companies be neutralized when applied to investment portfolios?

How can the impact of something that works so well for companies be neutralized when applied to investment portfolios?

Figure 1 – ESG impact on corporate financials vs investment portfolio performance (2015-2020)

Source: Atz, U. van Holt, T. et al. “Does sustainability generate better financial performance? review, meta-analysis, and propositions.” Journal of Sustainable Finance & Investment, 2022.

Investors preferences steer performance outcomes

One easy explanation is that many ESG investment strategies fail to focus on financially material ESG information. In other words, ESG factors that could have a significant impact – both positive and negative – on a company’s business model and value drivers, such as revenue growth, margins, required capital and risk. Analysts must focus on the right indicators and understand how they impact performance in each sector. For example, environmental indicators such as carbon emissions are more meaningful for energy-intensive industrial manufacturers than for service industries or the financial sector. And as always, it matters whether these material indicators are priced in by the market or not.

Besides financially material ESG information, there are also more complex factors at play that complicate the equation for investment portfolios. Companies focus primarily on profitability, growth and stock price performance. However, many sustainability-minded investors may be driven by other motives than pure profits and returns. Those investors prefer their investments to align with their personal ideologies and normative value systems. That means they may be willing to forgo some financial returns in exchange for higher marks on other portfolio ‘performance metrics’ such as a low-to-no exposure to ‘sin stocks’ such as online gambling outlets, tobacco producers or weapons manufacturers.

Sustainability-minded investors may be driven by other motives than pure profits and returns

Other sustainability-minded investors wish not only to screen out negative companies but also to actively orient their portfolios toward companies meeting ‘higher’ values criteria. These could be thought of as impact investors who wish to see their capital proactively allocated to companies and sectors whose products are positively responding to global concerns. Investment strategies focused on the climate crisis, resource scarcity, habitat degradation as well as workforce inequalities and human rights abuses are all examples of an impact-oriented investment approach.

Keep up with the latest sustainable insights

Join our newsletter to explore the trends shaping SI.

The Robeco experience – picking winners, avoiding losers, enhancing real-world impact

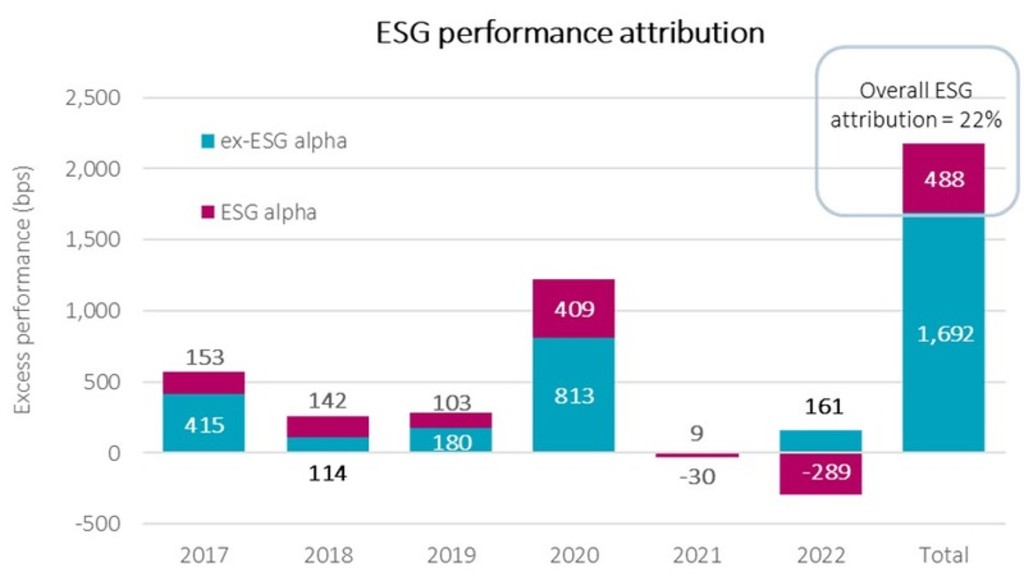

Robeco is built on decades of sustainability IP that enables us to customize and effectively accommodate a large spectrum of investment objectives and preferences across a range of asset classes. Our core fundamental equities strategies use ESG primarily as a tool to generate alpha. One strategy in particular, the Robeco Sustainable Global Stars Equities strategy, has even calculated an ESG impact attribution, showing that integrating various ESG dimensions into active stock picking has positively contributed to 22% of the strategy’s excess returns between 2017-2022 (see Figure 2). 5

Figure 2 – ESG’s contribution to performance in a sustainable equity portfolio

Source: Robeco, Sustainable Global Stars Equities strategy, 2017-2022

In contrast, our fixed income strategies, which are more oriented toward avoiding defaults, apply ESG analysis to protect against downside risk. In 2022, incorporating ESG into our proprietary fundamental scoring analyses led to a financially material impact in 29% of investment cases, 22% related to downside protection and 6% to capturing unpriced upside in bond prices.

Moreover, the rapidly increasing amount of available data has enabled our quantitative investment teams to develop algorithmic models to harvest financially-material sustainability signals that improve a portfolio’s risk-return profile. As previously noted, investors are increasingly concerned with contributing positive real-world impact in addition to reducing risks, preserving capital or capturing alpha. Recognizing this shift in investor preferences, the quant team has developed a customization tool that optimizes portfolios across expected returns, risk appetite and sustainability characteristics (e.g., carbon footprint, SDG impact).

Vigilance and innovation required

Our conviction of the value generated by sustainability is supported by extensive internal and external research. But we also realize that market dynamics can change over time. As with other forms of analysis the positive impact of any financially-material ESG data on returns can quickly lose its performance edge as more market participants discover and apply its benefits. Vigilance and continuous innovation are needed. We continue to enhance our research capabilities by adding new data sources, building new models and frameworks, and integrating the output within investment strategies across our entire range of asset classes.

The Big Book of Sustainable Investing

This article is based on a chapter in the Big Book of SI.

Footnotes

1 Friede, G. Busch, T. and Bassen, A. “ESG and financial performance: aggregated evidence from more than 2000 empirical studies.” (2015). Journal of Sustainable Finance & Investment, 5:4, 210-233

2 Atz, U. van Holt, T. et al. “Does sustainability generate better financial performance? review, meta-analysis, and propositions.” (2022). Journal of Sustainable Finance & Investment.

3 Atz, U. van Holt, T. et al. “Does sustainability generate better financial performance? review, meta-analysis, and propositions.” (2022). Journal of Sustainable Finance & Investment.

4 Harrison, H. and Kacperczyk, M. (2009). “The price of sin: The effects of social norms on markets”, Journal of Financial Economics, pp. 93-101

5 The Robeco Sustainable Global Stars Equities strategy uses the MSCI World EUR Index as a reference index.