Megatrends gather strength with productivity set to soar

A stepchange in productivity growth, powered by AI applications, makes the case for investing in the future economy stronger than ever, says the Robeco MegaTrends team, one decade on from launching the strategy.

概要

- Conviction matters as megatrends unfold over decades not months

- Breadth of exposure makes the MegaTrends strategy more resistant to sentiment swings

- AI complements megatrends, helping shape the future of our society, economy and natural environment

The profile of thematic and trends investing has been revitalized by the launch of generative AI models and the subsequent enthusiasm for semiconductor and cloud stocks. Regardless, the Robeco MegaTrends team believes the current equity market frenzy for the AI infrastructure names is obscuring a larger, and very positive, economic impact.

“For us, AI is a broad theme. You see that a lot of companies are investing in it, which we think is an important signal. AI solves one of the big economic problems of recent decades, namely stagnating productivity in the service sector. It’s a gamechanger for the global economy,” says Steef Bergakker, portfolio manager in the Megatrends team.

While generative AI via large language models is new, elements that are recognizably AI have actually been under development, in use and investable for two decades, says Marco van Lent, portfolio manager. “Machine learning is a well-established technology, and global industrial equipment names have for years been collecting and analyzing real-time data linked to a broader network to improve efficiency, and this has advanced industrial productivity. That same impact can now spread beyond the manufacturing sector,” he says.

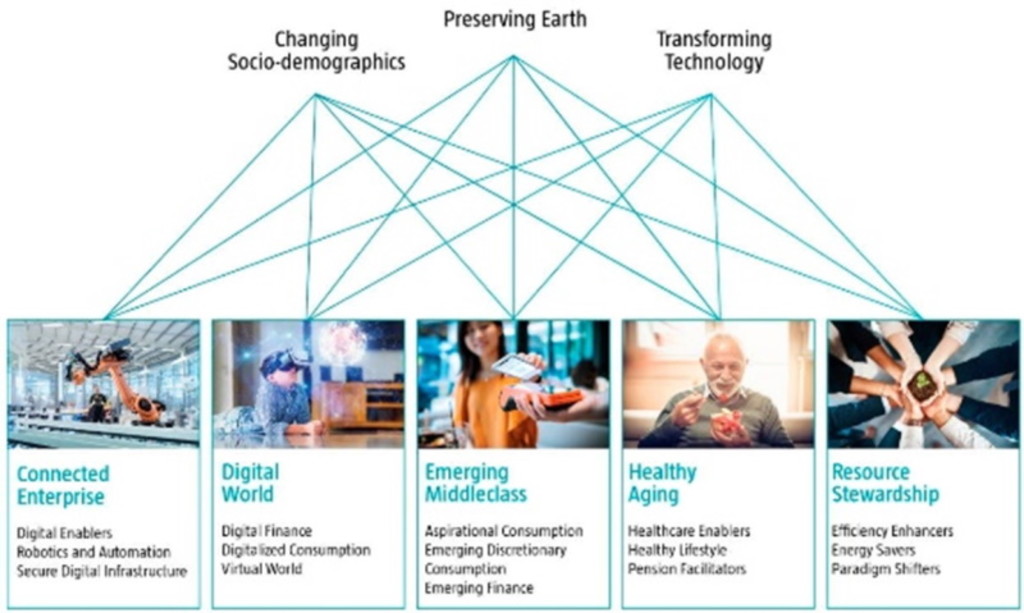

This impact will be felt across the five themes that the MegaTrends strategy invests in: connected enterprise, digital world, emerging middle class, healthy aging, and resource stewardship (see Figure 1 overleaf), says Dora Buckulčíková, portfolio manager.

“In healthcare for example, which falls within our healthy aging theme, improvements in image capture are combining with AI to create more accurate automated diagnoses, which is exciting because it can support earlier-stage disease intervention. This delivers real economic and societal benefits that reverberate beyond the healthcare sector,” she says.

“It enables the healthcare system to be more digital, efficient and personalized. And this is true for markets with rapidly aging populations, as well as in regions where healthcare services are difficult to obtain and where advances in imaging technology can improve patient access to appropriate care.”

Figure 1: The 5 major themes MegaTrends strategy follows

Source: Robeco

Scale matters

Large cloud companies are potentially looking to leverage their AI strength to enter new sectors, according to Van Lent. “A company like Microsoft, for instance, is going back to the healthcare sector with tools that convert speech to text and turning that into electronic health records for patients. That’s a way to sell more AI-related services.”

For some complex tasks like image manipulation and design, AI is already in use, says Bergakker. “It’s tearing down barriers for unskilled people to interact with these tools, and that is significant. Software companies that previously served a technical audience now have a bigger potential market. But it remains to be seen if, by removing barriers to entry, AI might undermine rather than extend their business model,” he adds.

Overall, the Megatrends team is united in the view that AI will have a positive economic impact and help solve societal challenges more than create them, Buckulčíková says.

“I think one important observation from our analysis of many different thematic areas is that scale matters – and that is especially true in an environment of rising interest rates where it’s more difficult for early-stage startups to raise funds. Very often it’s only the large companies that can really invest in innovative solutions.”

“For example, there is an increase in political and public pressure on utilities around the world to conserve natural water resources and to adopt smart monitoring and analytics infrastructure. This is the kind of multi-decade opportunity we like. Companies that make pumps, filtration equipment and control systems are increasingly using digital tools to enable more intelligent use and conservation of critical water resources,” she says.

Finding the right exposure

Once these themes with structural growth potential have been identified, the next task is to find the right exposure through a listed universe, and to harvest long-term returns. How does the team do this?

“Firstly, it’s teamwork. All three of us are free to come up with ideas that fall within the five themes and do more work on it,” says Van Lent. “There’s a lot of reading and of research involved, but also a degree of serendipity. Sometimes you simply stumble upon a good idea that fits a particular theme and then you start to dig a little deeper,” says Bergakker.

“The expertise of our colleagues who specialize in single-theme research is also a major source of inspiration”, Buckulčíková adds. “As the MegaTrends team is positioned at the center of all Robeco’s thematic strategies, we are in a unique position to draw and combine ideas from diverse angles, be it the circular economy, smart materials or fintech.”

Figure 2: Robeco single-theme equity strategies

Source: Robeco

For example, fintech has become a powerful change driver as finance is democratizing in less-developed economies, Buckulčíková points out.

“There are companies leapfrogging the existing banking infrastructure which you might see in typical developed markets – offering services that are more mobile and easier to access for growing populations that have been underserved until recently. Micro-finance in Indonesia and challenger banks in Brazil fit into this, and we think certain companies will be able to generate profitable growth sooner than the market is anticipating,“ she says.

釋放主題的投資潛能

25年多來,荷寶一直是主題策略建構的先驅者。

Pure long-term investing

Through years of experience the team has learned the importance of not being distracted by short-term volatility or fads.

“What we’ve learned is that this is pure long-term investing, whereas some supposed theme-focused products have tended to morph into momentum strategies. We resist these sentiment-driven swings and have shown in the past decade that thematic investing is really about the long term, and that’s why we have such a long average holding period,” says Bergakker.

“We have several companies that we’ve held since the strategy was launched in 2013,” says Van Lent. “Once we find an idea we obviously look at valuation, but we are not in the camp that sets a very strict target price. As we anticipate an exponential development of a new theme, we would feel very stupid to sell a certain holding before it truly benefits.”

Currently the Megatrends strategy holds positions for an average of 48 months.

“We’ve made small tweaks to the investment process and our investment horizon has definitely become a bit longer than when we launched the strategy. Bringing new perspectives into the team, as happened when Steef and Dora joined as portfolio managers, and leveraging the expertise of the rest of the Robeco thematic team, has also helped,” he says.

Buckulčíková points out that volatility sometimes helps the strategy recalibrate. For example, she says the supply chain disruption and volatility around the Covid pandemic offered up long-term opportunities to the MegaTrends strategy.

“The equity market has become very short term in recent years. Big swings in valuations of companies and in the sentiment around them provided us with opportunities to initiate positions where we were willing to look beyond transient issues, such as supply chain disruptions last year, to invest in long-term compounders.”

However, Van Lent also says that not every sub-trend has worked out the way the team originally anticipated.

“We were very excited about 3D-printing as part of the connected enterprise trend at the time of the launch of the strategy, almost ten years ago. In reality, though, it was really limited for a long time to very individual, small-scale usage scenarios and didn't get into the mainstream manufacturing process, so it wasn’t that investable. It’s still something we monitor and is now starting to emerge as a more important process, with Tesla for example,” he says.

The team also employs theoretical frameworks to help decision making, including the corporate life cycle framework.1 “This framework provides context to questions around business strategy, capital allocation and valuation, and helps us make better-informed investment decisions,” says Bergakker.

“Even when there’s serendipity, you can benefit from structure. It’s exactly what we need to ensure the Megatrends portfolio can continue to deliver in the next ten years and beyond.”

Footnote

1 See White Paper ‘A systematic approach to identifying companies’ life stages’ – Robeco – September 2023

全球多元趨勢投資

荷寶精選趨勢投資策略的一站式平台

Important information

The contents of this document have not been reviewed by the Securities and Futures Commission ("SFC") in Hong Kong. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice. This document has been distributed by Robeco Hong Kong Limited (‘Robeco’). Robeco is regulated by the SFC in Hong Kong. This document has been prepared on a confidential basis solely for the recipient and is for information purposes only. Any reproduction or distribution of this documentation, in whole or in part, or the disclosure of its contents, without the prior written consent of Robeco, is prohibited. By accepting this documentation, the recipient agrees to the foregoing This document is intended to provide the reader with information on Robeco’s specific capabilities, but does not constitute a recommendation to buy or sell certain securities or investment products. Investment decisions should only be based on the relevant prospectus and on thorough financial, fiscal and legal advice. Please refer to the relevant offering documents for details including the risk factors before making any investment decisions. The contents of this document are based upon sources of information believed to be reliable. This document is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. Investment Involves risks. Historical returns are provided for illustrative purposes only and do not necessarily reflect Robeco’s expectations for the future. The value of your investments may fluctuate. Past performance is no indication of current or future performance.