Consumer trends in 2020: food delivery, humanization of pets and streaming wars

New year, new investment ideas? As investors reassess the prospects for the global economy and financial markets in 2020, trend investors Jack Neele and Richard Speetjens highlight three major trends that are shaping consumers’ spending preferences globally.

まとめ

- Food delivery is set for strong growth and consolidation

- Pet-related products and services are booming

- Streaming wars: new players in an expanding market

Online food ordering and delivery is a relatively young market that, after a period of heavy investment, is now quickly consolidating. One of the main drivers of this move has been the low profitability of many players, as penetration still tends to be relatively low and traditional phone ordering often remains the number one competitor.

But in regions where concentration is high and penetration has been increasing, companies are now seeing their profits rising rapidly. This in turn should lead to further concentration and to the emergence of a small number of dominant players able to generate profits while their competitors probably keep struggling. Figure 1 shows the main players in different online food delivery markets.

Figure 1: Main players in different online food delivery markets

Source: Frost & Sullivan, Robeco

Winners will be those able to keep their delivery costs as low as possible, either because, in the country they operate, the cost of labour is low or because the density of their customer network is very high. In countries where the population is highly concentrated in big cities, like South Korea for example, online food delivery companies will obviously be at an advantage.

According to Neele and Speetjens, the sector will keep growing and consolidating rapidly over the next couple of years. Online food delivery penetration on average is around 10% to 12%, whereas in more developed markets, like the UK and the Netherlands, this can be as high as 25%. Therefore, potential growth remains substantial in many markets.

Last year saw a major consolidation moves in large food delivery markets, such as Germany, the UK and South Korea. These mergers gave birth to dominant food delivery companies able to generate high and robust profit margins.

The online food delivery sector will keep growing and consolidating rapidly over the next couple of years

Humanization of pets

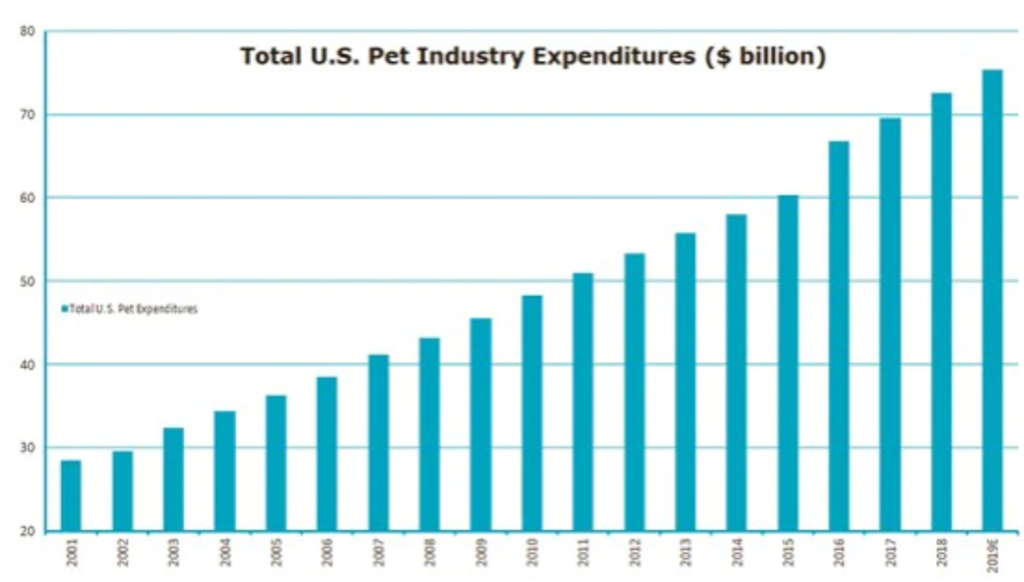

The number of pet-owning households is rising globally while the amount of money people spend on their furry companions is also increasing. In the US, for instance, over 55% of the households own a pet, according to the American Veterinary Medical Association’s latest survey. Moreover, pet industry sales have been steadily rising over the years, even during the crisis of 2008-2009, as Figure 2 shows.

Download now

Figure 2: Total US pet industry expenditures (in USD billions)

Source: American Pet Products Association, Robeco

To some extent, the constant increase in global consumer spending in the household and pet care categories can be attributed to a ‘pet-humanization’ trend. Consumers increasingly see their pets as family members. Many consumers are therefore prepared to spend more on pet food and other pet-related products that may improve animals’ living conditions.

One way to benefit from this trend is to invest in either pet food providers, or companies that supply vaccines and medicine for pets. These food and pharmaceutical companies may not necessarily focus solely on pets, but in some cases, the pet segment can represent a very sizable share of their sales and profits. These also tend to be high-growth and high-margin businesses.

But there are also many other types of companies that could benefit from this trend, Neele and Speetjens say. For instance, online pet food delivery companies may be one example. As pet food is large and bulky, the online distribution model is very suitable for pet food. The online pet food and pet supplies market currently has approximately 15% penetration in the US, but this could easily increase to more than 25% in the next few years.

Streaming wars

Streaming wars is not a new topic, but the past few months have been marked by several initiatives that could reshuffle the deck. While Netflix has long been the dominant player, Apple and Disney are now also offering their own service. For these companies, the idea is to establish a direct link with the end consumer to help them decide on future investments in terms of content.

Figure 3: Streaming wars

Source: Getty

Of course, the increased level of competition may limit pricing power in the short term. But the market should be big enough for Disney and Netflix to co-exist, say Neele and Speetjens. Moreover, a more diversified streaming offering will probably lead a growing number of customers to replace their usual TV subscription with a combination of online streaming subscriptions.

A more diversified streaming offering will probably lead a growing number of customers to replace their usual TV subscription with a combination of online streaming subscriptions

Also related to the streaming wars are all the changes happening in the music industry. After two decades of decline, growth has finally come back over the past couple of years, in particular thanks to the success of a handful of streaming platforms. These days, streaming represents about 45% to 50% of the total music industry in terms of revenues. Owning streaming platforms or music labels is one way of benefiting from this comeback. But there are other ways. For instance, because the business model of artists has radically changed and streaming is now seen as a way to promote concerts, companies operating concert venues or selling concert tickets online may also represent attractive investment opportunities.

Conclusion

Given an uncertain future, with potentially slower economic growth and the current backdrop of very low global interest rates, we believe investors should focus on quality growth stocks. High quality businesses with valuable intangible assets, low capital intensity, high margins and superior returns on capital have historically delivered above average returns while offering downside protection in volatile market environments.

We believe our investments in food delivery, pet care and expenditures, as well as music and video streaming feature such characteristics. Therefore, we expect them to deliver healthy revenue and earnings growth and to generate attractive long term returns for investors. Moreover, we believe the above-average valuations of some of these businesses are justified, given the quality of their business models, the high levels of earnings growth and the sustainability of their franchises.

重要事項

当資料は情報提供を目的として、Robeco Institutional Asset Management B.V.が作成した英文資料、もしくはその英文資料をロベコ・ジャパン株式会社が翻訳したものです。資料中の個別の金融商品の売買の勧誘や推奨等を目的とするものではありません。記載された情報は十分信頼できるものであると考えておりますが、その正確性、完全性を保証するものではありません。意見や見通しはあくまで作成日における弊社の判断に基づくものであり、今後予告なしに変更されることがあります。運用状況、市場動向、意見等は、過去の一時点あるいは過去の一定期間についてのものであり、過去の実績は将来の運用成果を保証または示唆するものではありません。また、記載された投資方針・戦略等は全ての投資家の皆様に適合するとは限りません。当資料は法律、税務、会計面での助言の提供を意図するものではありません。 ご契約に際しては、必要に応じ専門家にご相談の上、最終的なご判断はお客様ご自身でなさるようお願い致します。 運用を行う資産の評価額は、組入有価証券等の価格、金融市場の相場や金利等の変動、及び組入有価証券の発行体の財務状況による信用力等の影響を受けて変動します。また、外貨建資産に投資する場合は為替変動の影響も受けます。運用によって生じた損益は、全て投資家の皆様に帰属します。したがって投資元本や一定の運用成果が保証されているものではなく、投資元本を上回る損失を被ることがあります。弊社が行う金融商品取引業に係る手数料または報酬は、締結される契約の種類や契約資産額により異なるため、当資料において記載せず別途ご提示させて頂く場合があります。具体的な手数料または報酬の金額・計算方法につきましては弊社担当者へお問合せください。 当資料及び記載されている情報、商品に関する権利は弊社に帰属します。したがって、弊社の書面による同意なくしてその全部もしくは一部を複製またはその他の方法で配布することはご遠慮ください。 商号等: ロベコ・ジャパン株式会社 金融商品取引業者 関東財務局長(金商)第2780号 加入協会: 一般社団法人 日本投資顧問業協会