Digging deeper for safer mining as engagement theme closes

Nine out of ten mining companies have improved their sustainability after a three-year engagement program by Robeco’s Active Ownership team.

まとめ

- High success rate in encouraging miners to improve their sustainability

- Engagement focused on water risk, tailings dams and retiring assets

- Most progress seen in water management, less so on mine closures

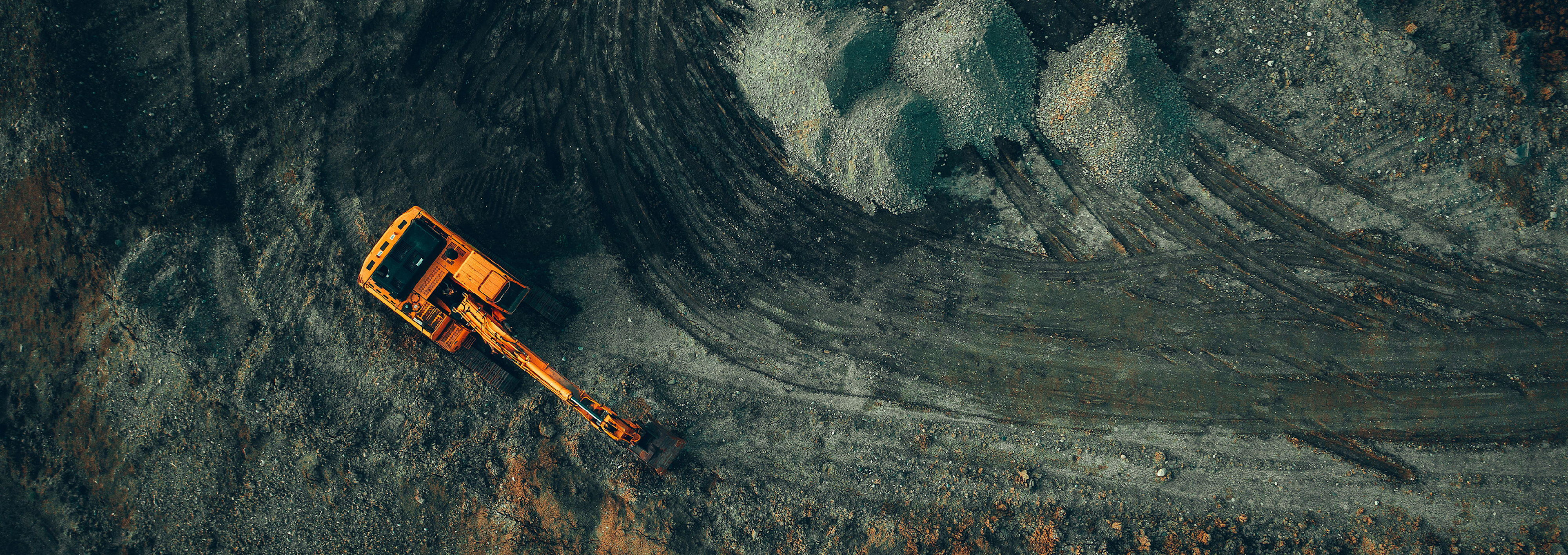

The success rate was achieved following dialogues with some of the world’s largest miners who extract some of our most sought-after minerals including iron ore, aluminum and gold. The sector is becoming more important because of increasing demand for clean technologies such as solar panels, wind turbines and electric vehicles that require metals and minerals like lithium and cadmium.

Yet it has one of the worst safety records of all industrial sectors, highlighted when hundreds died in tailings dam disasters in Brazil in 2015 and 2019. Mining activities often have negative impacts on landscapes, disrupt ecosystems, and divert scarce water resources from local communities.

Robeco originally engaged with 14 large mining companies located across four continents from 2020 to 2023. The dialogues were centered around nine objectives, three of which targeted water risk management, three assessed the management of tailings dam – where by-products from the mining process are kept – and three looked at retiring depleted assets.

Engagement with four companies was halted. Two cases could not continue due to the Russia-Ukraine war, while one case was referred to Robeco’s Controversies Engagement program following a severe environmental breach. The fourth case was transferred to the Sustainable Development Goals theme where the objectives were expanded to cover social and governance issues.

“Almost all the remaining companies significantly improved their water risk management,” says Engagement Specialist Sylvia van Waveren, who led the theme for three years. “They are doing so through better water policies, actions at the asset level, and having a relevant focus on water consumption and quality. Nine out of ten have adopted adequate water management policies, while eight are now disclosing the performance of their operations on water-related metrics.”

“Given the context of European regulations, enhancing performance on reducing water consumption and mitigating adverse impacts on water quality is as relevant as ever. We encouraged the companies to set targets and report progress on their performance on water use efficiency, water recycling and safe reuse.”

“More attention is needed for setting targets, though. Only six companies have set targets to improve water use efficiency, while two others are planning to do so in the near future.”

Progress with tailings dams

The safety of tailings dams has been a priority following two disasters at iron ore mines in Brazil. Some 270 people were killed when the Brumadinho tailings dam collapsed in 2019, unleashing a mudflow that engulfed local buildings. It followed a similar incident in 2015, when 19 people were killed when the Samarco tailings dam collapsed, resulting in extensive flooding and pollution.

The Investor Mining and Tailings initiative, led by the Church of England, was launched to improve focus and data collection in this dangerous arena. “When we look at the issue of tailings safety, we see that the industry has responded positively to the global call for enhanced disclosures after the two major tailing dam breaches in Brazil,” Van Waveren says.

“In our peer group, eight companies now disclose all their tailings storage facilities under operation to the Global Tailings Database. Moreover, nine companies have committed to implementing the Global Industry Standard on Tailings Management, which sets best practice on integrating environmental, social and technical considerations.”

“However, our objective on phasing out high-risk tailing storage structures has seen less traction, with only two companies committing to developing dry-tailings storage for any new facilities, and five considering measures to mitigate safety risks from dams classified as high-risk. To guarantee environmental and human safety, each company is expected to set targets for the phasing out, or decommissioning, of its high-risk tailings dams.”

最新のインサイトを受け取る

投資に関する最新情報や専門家の分析を盛り込んだニュースレター(英文)を定期的にお届けします。

Disappointing asset retirement issues

Engagement on asset retirement was less successful than for water and tailings. The companies had been asked to integrate closure activities into their mine business plans, including end-of-life planning processes. They were also asked to give ring-fenced financial assurances that would cover reclamation costs to redress impacts on wildlife, soil and water quality.

“Here, our results were mixed, with only one company scoring well on the three sub-targets on asset retirement issues,” Van Waveren says. “This company stood out by establishing closure plans for all its mines before construction had begun.”

“These plans outlined the steps to be taken throughout the mine’s life to deliver an effective and environmentally sound end to operations, including the rehabilitation of the surrounding area and protection of water resources. The company also strengthened its mine closure standards by the appointment of a new global Vice-President of Closure and Governance in 2022.”

“In general, though, we found that the financial assurances for mine closure need to be much better disclosed in their annual reports.”

Launch of Mining 2030

While the engagement theme has closed, work continues to make the mining industry safer and more sustainable. In January 2023, a global initiative called Mining 2030 was launched by investors, NGO and the miners themselves to raise sustainability standards by the end of this decade.

Mining 2030 will develop an ambitious agenda to ensure that growth in mineral demand for products such as electric cars does not harm people or the environment. It will address key systemic risks that challenge the mining sector’s ability to meet increasing mineral demand for the low-carbon transition on the basis that ‘without mining, there can be no energy transition’.

Focus areas of the initiative include the impact of mining on biodiversity and climate change, corruption in the industry, the legacy of mining and rehabilitation, water risk management, seabed mining and many other material issues.

“We expect to play an active role in the initiative, which will lead to the identification of global best practice standards and disclosures in the mining sector,” Van Waveren concludes.

重要事項

当資料は情報提供を目的として、Robeco Institutional Asset Management B.V.が作成した英文資料、もしくはその英文資料をロベコ・ジャパン株式会社が翻訳したものです。資料中の個別の金融商品の売買の勧誘や推奨等を目的とするものではありません。記載された情報は十分信頼できるものであると考えておりますが、その正確性、完全性を保証するものではありません。意見や見通しはあくまで作成日における弊社の判断に基づくものであり、今後予告なしに変更されることがあります。運用状況、市場動向、意見等は、過去の一時点あるいは過去の一定期間についてのものであり、過去の実績は将来の運用成果を保証または示唆するものではありません。また、記載された投資方針・戦略等は全ての投資家の皆様に適合するとは限りません。当資料は法律、税務、会計面での助言の提供を意図するものではありません。 ご契約に際しては、必要に応じ専門家にご相談の上、最終的なご判断はお客様ご自身でなさるようお願い致します。 運用を行う資産の評価額は、組入有価証券等の価格、金融市場の相場や金利等の変動、及び組入有価証券の発行体の財務状況による信用力等の影響を受けて変動します。また、外貨建資産に投資する場合は為替変動の影響も受けます。運用によって生じた損益は、全て投資家の皆様に帰属します。したがって投資元本や一定の運用成果が保証されているものではなく、投資元本を上回る損失を被ることがあります。弊社が行う金融商品取引業に係る手数料または報酬は、締結される契約の種類や契約資産額により異なるため、当資料において記載せず別途ご提示させて頂く場合があります。具体的な手数料または報酬の金額・計算方法につきましては弊社担当者へお問合せください。 当資料及び記載されている情報、商品に関する権利は弊社に帰属します。したがって、弊社の書面による同意なくしてその全部もしくは一部を複製またはその他の方法で配布することはご遠慮ください。 商号等: ロベコ・ジャパン株式会社 金融商品取引業者 関東財務局長(金商)第2780号 加入協会: 一般社団法人 日本投資顧問業協会