サステナブル投資家としての防衛産業への投資

欧州政府がロシアの脅威に対抗するために防衛費を増額するなかで、投資家は防衛関連企業への投資拡大を迫られています。

まとめ

- 欧州はロシアの脅威に対抗するため防衛費増額を呼びかけ

- 通常兵器は、主要ポートフォリオでは以前から投資対象

- クラスター弾のような論争の的となる兵器は従前より除外

トランプ米大統領は、ロシアのウクライナ侵攻を受け、NATO全加盟国に対し、国防費をGDP比2%以上に引き上げること、そして欧州の安全保障については欧州自身がより大きな責任を負うことを求めています。

ブリュッセルで開催された特別首脳会議で、EU首脳は、8000億ユーロの「欧州再軍備計画(ReArm Europe)」に合意し、ウクライナおよびロシアとの国境地帯を防衛するために防衛費を大幅増額する方針を示しました。これを受け、防衛費増額の恩恵が見込まれる航空宇宙・防衛関連株が他の多くのセクターをアウトパフォームしました。

ロベコにおいては、論争の的となる兵器製造企業に対する投資除外方針を継続する一方、防衛産業やその関連サービス企業への投資は従前より可能であり今後拡大する可能性があるとの見解を、ロベコのマルチアセット運用およびサステナブル投資の専門家は示しています。

ロベコ・サステナブル・マルチアセット・ソリューションズのポートフォリオ・マネジャーであるAliki Rouffiacは、次のように述べています。「ロベコは、持続可能でなく望ましくない紛争との本質的な関わりを踏まえ、防衛産業への投資には消極姿勢をとる傾向にあります。マルチアセット運用を行う投資家として、防衛費に関してはリスク、リターン、サステナビリティのトレードオフのバランスを取りたいと考えます。」

「長期的には、欧州の政策が防衛費増額へと大きく転換していることから、その恩恵を享受できるようなポジションをとるべきです。欧州再軍備計画は、同地域の安全保障のために大規模な新規投資が行われることを意味します。」

「そうであれば、航空宇宙・防衛サブセクターの比重は、グローバル株式指数に対する現在の比重である2%を超えて拡大すると見込まれます。その一方で、 市場の他のセクターも支出増の恩恵を受けるでしょう。」

サステナビリティに関する最新のインサイトを把握

ロベコのニュースレター(英文)に登録し、サステナブル投資の最新動向を探求しましょう。

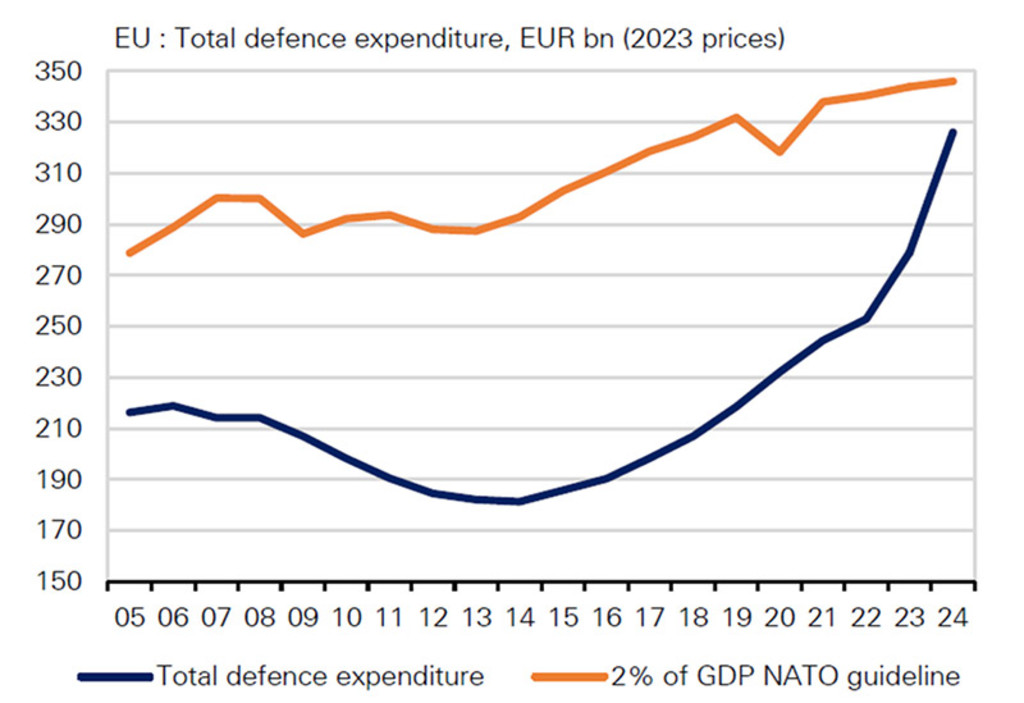

Source: Deutsche Bank, European Defence Agency. Note 2024 figure is estimate

2014年のクリミア併合に続き、2022年2月にロシアがウクライナ東部に侵攻したことにより、軍事情勢だけでなく世界経済も一変し、エネルギー、食料品、コモディティの大幅なインフレが引き起こされました。中央銀行はインフレを抑制するため、今も金利との戦いを続けています。

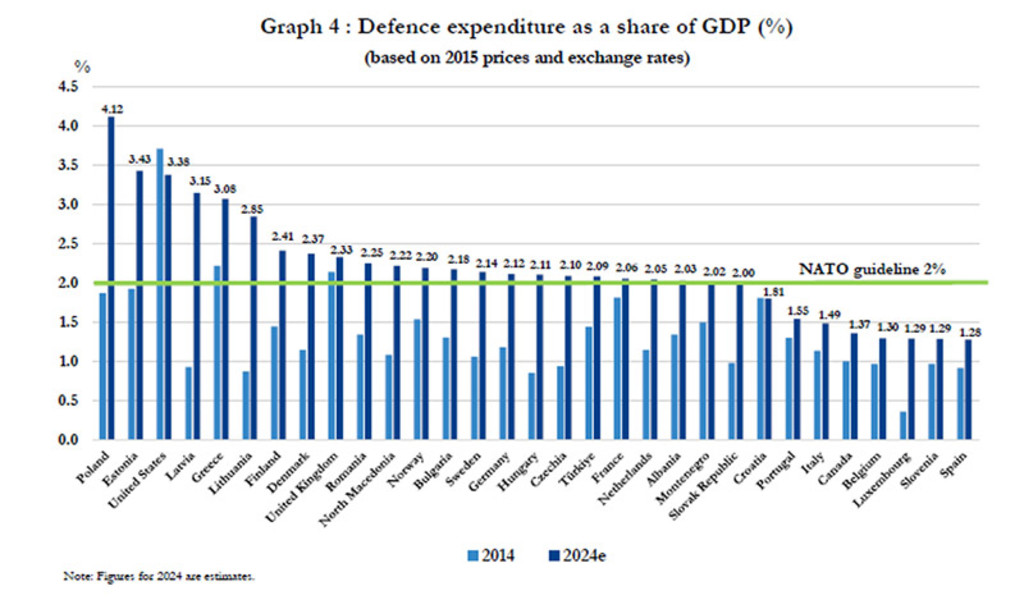

西側諸国の防衛費は、年間GDP比5.86%を費やしているロシアよりも大幅に低水準です1 。NATO加盟国31ヵ国のうち、8ヵ国は未だにGDP比2%というガイドラインを満たしておらず、スペインは1.28%、イタリアは1.49%となっています。NATO本部のあるベルギーはわずか1.30%となっています2 。

欧州で防衛費が最も高水準なのは、いずれもロシアと国境を接しているポーランドとバルト三国となっています。米国は年間GDP比3.38%を支出し、軍事予算は約1兆ドルと世界一の規模になっています。

NATO加盟国の防衛費 出所:Forces News、NATO

主要ポートフォリオにおける防衛関連企業

ロベコのサステナブル投資責任者であるCarola van Lamoenは、次のように述べています。「責任ある投資家として、ロベコでは従前より主要ポートフォリオにおいて防衛産業への投資が可能であり、足下では明らかにその意味合いが高まっています。」

「ロベコの主要な運用戦略では、論争の的となる兵器は投資対象から除外しつつ、防衛産業への投資は可能としています。ロベコでは、変化する地政学的情勢や、欧州大陸の防衛における欧州各国政府の責任の増大を認識しています。こうした変化は、防衛セクターへの投資拡大にもつながります。」

「ロベコでは、ESG原則の統合にコミットしており、お客様の目的を考慮しそれに合わせて調整することで、お客様のリターン、リスク、サステナビリティ目標のバランスを取っています。」

除外対象となる兵器

ロベコは、クラスター弾、対人地雷、白リン弾、劣化ウラン弾に加え、化学兵器、生物兵器、核兵器を、論争の的となる兵器として問題視しています。ほぼすべてが国際条約で禁止されています 。これらはロベコの除外方針レベル1の対象です3。レベル1は全投資戦略に適用されるため、ロベコでは投資対象外となります。

除外方針レベル2は、ロベコのカスタムメイドのサステナブル投資ポートフォリオで採用されています。より厳格な対応として、サステナブルでないと分類される活動に従事する企業を具体的に除外します。レベル2では、防衛分野においては、軍事契約が収益において一定の基準を超える企業が除外されます。

Van Lamoenは、次のように述べています。「ロベコで最もサステナブル特性が高い投資戦略群では、防衛産業には投資しません。ロベコでは兵器をサステナブル投資とは定義していないからです。すなわち、防衛への投資は責任ある投資とは言えますが、サステナブルではありません。」

間接的な投資

軍隊やそのインフラを支えるという、非致死性の支援産業への投資機会もあります。かつてナポレオンが「軍隊は胃袋で動く」と語ったように、軍隊への食料供給やその関連企業への投資機会も存在します。投資家はまた、高性能軍服の納入業者、物流企業、衛星技術、またはそうした企業のいずれかに融資する銀行に目を向けることも可能です。

北朝鮮のハッカー集団が10億米ドル相当の暗号資産を盗んだと言われるように、現代の戦争は戦場だけで起こっているわけではありません。これによりサイバーセキュリティにも投資機会がもたらされています。

Rouffiacは、次のように述べています。「また、ロベコのサステナブル投資原則と密接に組み合わせることで、アクティブ運用アプローチを後押しすることにもなります。投資可能な企業と真に除外方針に該当する企業との区別が可能になるのです。」

「これは、革命ではなく進化と言えましょう。防衛費引き上げ計画案には各国政府の批准が必要であり、まだ時間がかかるかもしれません。また、ロシアとウクライナの和平交渉が行われる可能性もあり、そうなれば緊急性が薄れることも予想されます。つまり、柔軟なアプローチを維持するべきと言えましょう。」

1 https://data.worldbank.org/indicator/MS.MIL.XPND.GD.ZS?locations=RU

2 https://www.forcesnews.com/news/world/nato-which-countries-pay-their-share-defence

3 オタワ条約(1997年)は、対人地雷の使用、貯蔵、生産、移譲を禁止しています。クラスター爆弾禁止条約(2008年)は、クラスター爆弾の使用、貯蔵、生産、移譲を禁止しています。化学兵器禁止条約(1997年)は、化学兵器の使用、貯蔵、生産、移譲を禁止しています。生物兵器禁止条約(1975年) は、生物兵器の使用、貯蔵、生産、移譲を禁止しています。核兵器不拡散条約(1968年)は、核兵器の拡散を、定められた核兵器保有国(米国、ロシア、英国、フランス、中国)に限定しています。

重要事項

当資料は情報提供を目的として、Robeco Institutional Asset Management B.V.が作成した英文資料、もしくはその英文資料をロベコ・ジャパン株式会社が翻訳したものです。資料中の個別の金融商品の売買の勧誘や推奨等を目的とするものではありません。記載された情報は十分信頼できるものであると考えておりますが、その正確性、完全性を保証するものではありません。意見や見通しはあくまで作成日における弊社の判断に基づくものであり、今後予告なしに変更されることがあります。運用状況、市場動向、意見等は、過去の一時点あるいは過去の一定期間についてのものであり、過去の実績は将来の運用成果を保証または示唆するものではありません。また、記載された投資方針・戦略等は全ての投資家の皆様に適合するとは限りません。当資料は法律、税務、会計面での助言の提供を意図するものではありません。 ご契約に際しては、必要に応じ専門家にご相談の上、最終的なご判断はお客様ご自身でなさるようお願い致します。 運用を行う資産の評価額は、組入有価証券等の価格、金融市場の相場や金利等の変動、及び組入有価証券の発行体の財務状況による信用力等の影響を受けて変動します。また、外貨建資産に投資する場合は為替変動の影響も受けます。運用によって生じた損益は、全て投資家の皆様に帰属します。したがって投資元本や一定の運用成果が保証されているものではなく、投資元本を上回る損失を被ることがあります。弊社が行う金融商品取引業に係る手数料または報酬は、締結される契約の種類や契約資産額により異なるため、当資料において記載せず別途ご提示させて頂く場合があります。具体的な手数料または報酬の金額・計算方法につきましては弊社担当者へお問合せください。 当資料及び記載されている情報、商品に関する権利は弊社に帰属します。したがって、弊社の書面による同意なくしてその全部もしくは一部を複製またはその他の方法で配布することはご遠慮ください。 商号等: ロベコ・ジャパン株式会社 金融商品取引業者 関東財務局長(金商)第2780号 加入協会: 一般社団法人 日本投資顧問業協会