In sickness and in wealth – opportunities in health care for active investors

It’s a sector that accounts for 9% of global GDP, and uniquely will be used by everyone at some point in their lives. And as the population ages and technology advances, health care is set to become one of the most interesting arenas for stock pickers, says analyst Alyssa Cornuz.

まとめ

- Health care to benefit from aging and rising burden of chronic conditions

- Pipelines remain crucial for profits but patent cliffs hamper progress

- AI is assisting development of new cures as digitalization trends grow

Spending on health care in the US alone reached USD 4.5 trillion in 2023, an amount greater than the GDP of Japan. Priorities within the sector have changed since the Covid pandemic, though it remains the ultimate long-term theme as the global population gets older and sicker.

“Globally, several structural factors are driving this trend, including an aging population, with projections indicating that by 2050, one in every six individuals worldwide will be over 65, compared with one in 11 currently,” says Cornuz, healthy living analyst with Robeco’s thematic equity team.

“Then there is the rising burden of chronic conditions, such as cardiovascular diseases, cancer or diabetes, and increased demand for health care services in emerging markets. This provides an opportunity for investors to discover companies that can apply new AI technologies, develop new cures, and improve the effectiveness of health care spending generally.”

“However, there remain some challenging headwinds, including reduced revenues for health care suppliers post-Covid, drug price controls, and regulatory uncertainty; rebates for Medicare in the US created a challenging backdrop for parts of the sector in 2023.”

“On top of that, the launch of GLP-1 drugs for obesity led to massive dispersion in performance between Big Pharma, MedTech and other health care sub-sectors. While more dispersion and macro uncertainty are likely in 2024, this provides the active stock picker with more opportunities than seen in recent years, with valuation support and more divergence between winners and losers.”

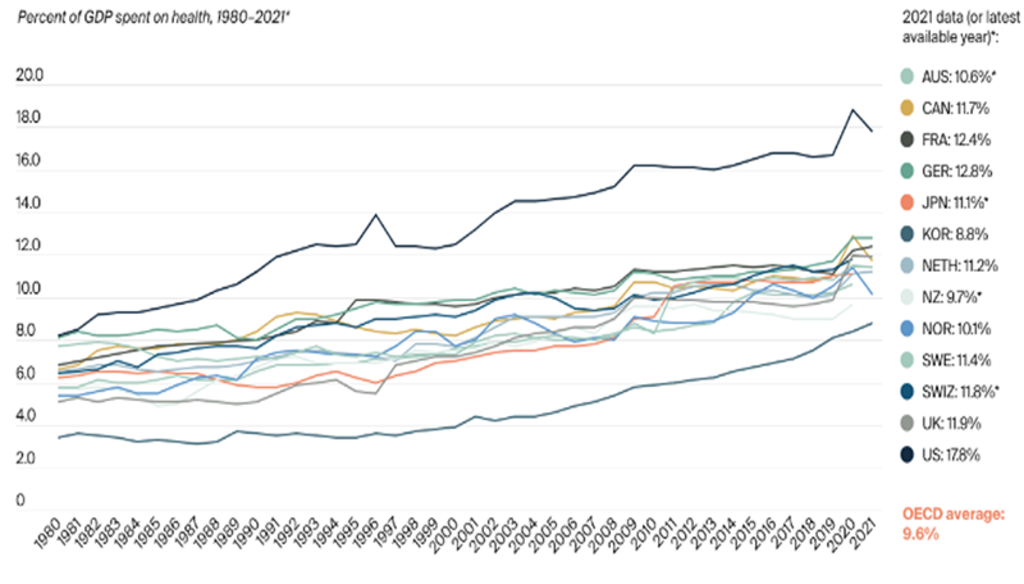

The percentage of GDP spent on health care; the US leads the pack at 17.8%.

Source: Morgan Stanley

Cornuz says three factors stand out, led by recovery in the biotech and life sciences sectors, the prospect of no upsets in the upcoming US Presidential and Congressional elections, and a refocus on attractive therapeutic areas beyond GLP-1.

“M&A activity in biotech has seen a pick-up in the year to date that is likely to persist, albeit with a shift towards acquiring later-stage assets, as Big Pharma replenishes its pipelines,” she says.

“Health care is not expected to be a central theme in the US elections. Although large cap pharma and managed care remain exposed to headwinds such as repeal of the Affordable Care Act, other sub-sectors such as life sciences tools or contract research organizations (CROs) or contract manufacturing organizations (CMOs) involved in making new drugs should remain insulated.”

“Finally, the market focus is moving past drugs for obesity to other product cycles such as tackling Alzheimer’s disease or developing respiratory vaccines.”

Healthy living

Pipelines, patents and profits

Cornuz says the pipeline of new drugs underpins growth in the sector, particularly as patents expire for blockbuster products. Patents provide immunity from competition while they are active, making them into de facto monopolies, but other companies can manufacture the same product once they expire.

“The race to discover a Covid-19 vaccine put a spotlight on the industry’s ability to rapidly innovate, but the patent cliff is always a drag on Big Pharma that is set to cost the industry USD 180 billion in lost revenue by the end of the decade,” Cornuz says.

“So, building on the acceleration of innovation through faster product cycles or M&A is a key theme for the sector. Notable therapeutic areas offering growth opportunities include oncology, immunology, diabetes/obesity, and neurology, particularly for tackling Alzheimer's disease.”

AI lends a helping hand

Pipelines are a risky business, since developing a new drug typically takes eight to ten years and costs USD 1-2 billion per product, with only one out of every ten candidates ever reaching the market with regulatory approval. So, can artificial intelligence help?

“AI has the potential to shorten product development by contributing to faster drug discovery and the reduction of clinical trial failure rates,” Cornuz says. “With data integration, trend recognition and predictive modeling, AI can speed up the understanding of diseases and help to identify future winners in the traditional drug discovery process, while machine learning algorithms can optimize clinical trial designs.”

“Beyond drug development, data-driven digital health care tools have the potential to improve patient outcomes while reducing inefficiencies. In a sector plagued with shortages of skilled labour, AI can help facilitate patient care from pre-appointment to diagnostics, and reduce hospitals’ administrative burdens.”

Spending on digitalization

Digitalizing the sector – the subject of a past engagement theme at Robeco – is also both a long-term cost and opportunity for a sector that relies on accurate medical records and the ability to track the effectiveness of doctors’ prescriptions. Investments in digital health totalled USD 45 billion during the pandemic, ranging from clinical trials technology to home health and wellness.

“From 2020-2022, health care was the sector with the highest capital invested in AI after IT,” Cornuz says. “Funding since the pandemic ended has steeply declined, pressured by rising interest rates.”

“The headwinds facing the sector are well understood; what is not is how investments in digital and AI tools are providing clear productivity gains. That is yet to come, and will be an issue for investors to consider in this vibrant but always challenging sector.”

最新のインサイトを受け取る

投資に関する最新情報や専門家の分析を盛り込んだニュースレター(英文)を定期的にお届けします。

重要事項

当資料は情報提供を目的として、Robeco Institutional Asset Management B.V.が作成した英文資料、もしくはその英文資料をロベコ・ジャパン株式会社が翻訳したものです。資料中の個別の金融商品の売買の勧誘や推奨等を目的とするものではありません。記載された情報は十分信頼できるものであると考えておりますが、その正確性、完全性を保証するものではありません。意見や見通しはあくまで作成日における弊社の判断に基づくものであり、今後予告なしに変更されることがあります。運用状況、市場動向、意見等は、過去の一時点あるいは過去の一定期間についてのものであり、過去の実績は将来の運用成果を保証または示唆するものではありません。また、記載された投資方針・戦略等は全ての投資家の皆様に適合するとは限りません。当資料は法律、税務、会計面での助言の提供を意図するものではありません。 ご契約に際しては、必要に応じ専門家にご相談の上、最終的なご判断はお客様ご自身でなさるようお願い致します。 運用を行う資産の評価額は、組入有価証券等の価格、金融市場の相場や金利等の変動、及び組入有価証券の発行体の財務状況による信用力等の影響を受けて変動します。また、外貨建資産に投資する場合は為替変動の影響も受けます。運用によって生じた損益は、全て投資家の皆様に帰属します。したがって投資元本や一定の運用成果が保証されているものではなく、投資元本を上回る損失を被ることがあります。弊社が行う金融商品取引業に係る手数料または報酬は、締結される契約の種類や契約資産額により異なるため、当資料において記載せず別途ご提示させて頂く場合があります。具体的な手数料または報酬の金額・計算方法につきましては弊社担当者へお問合せください。 当資料及び記載されている情報、商品に関する権利は弊社に帰属します。したがって、弊社の書面による同意なくしてその全部もしくは一部を複製またはその他の方法で配布することはご遠慮ください。 商号等: ロベコ・ジャパン株式会社 金融商品取引業者 関東財務局長(金商)第2780号 加入協会: 一般社団法人 日本投資顧問業協会