New multi-thematic strategy provides a one-stop shop to a world of opportunities

The latest strategy captures the very best of Robeco’s thematic investing, expanding exposure to even more themes while diversifying risks. More broadly, investors gain early access to the forces shaping tomorrow, carefully curated into one portfolio.

まとめ

- Exposure to more attractive themes while reducing concentration risks

- Leverages a wealth of pioneering thematic research and SI analytics

- Systemically distils a universe of insights into a single portfolio

The Global Multi-Thematic strategy builds on the foundations of an existing strategy distinguished by more than a decade of successfully investing in evolving themes and structural change. 1 The new strategy will now cover all of Robeco’s pure-play thematic strategies opening access to a diverse range of global equities. It also features a re-tooled investment process to efficiently distill the ‘best- of’ thematic stocks from a significantly expanded universe.

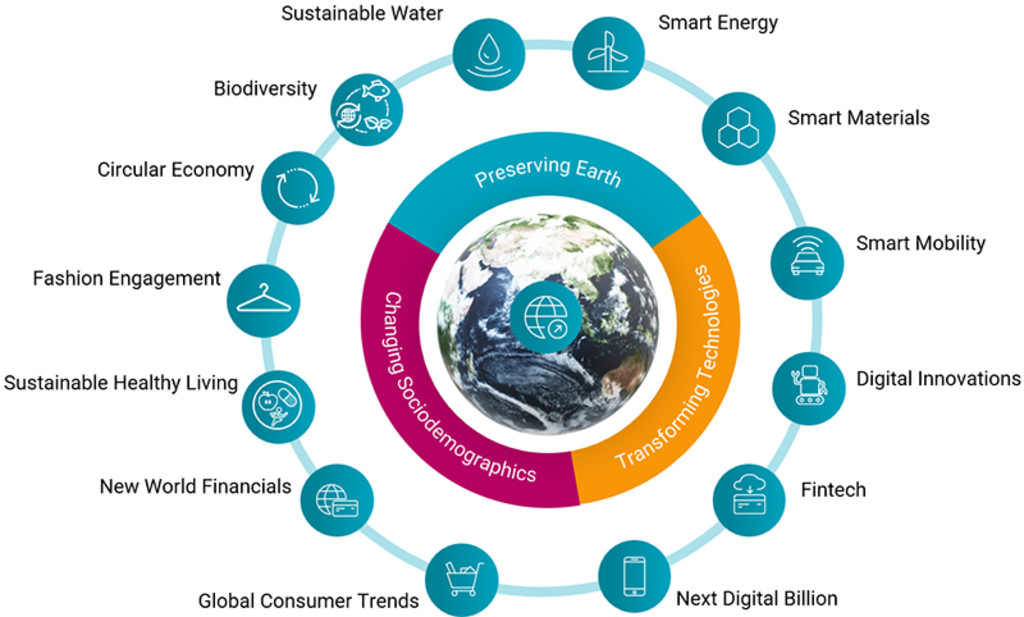

The investment process centers on three megatrends – Preserving Earth, Transforming Technologies, and Changing Sociodemographics – which the team believes are driving substantial opportunities for innovation and long-term returns. “The future takes shape through the lens of megatrends. We observe and anticipate their evolution in business and society and build scenarios for the types of products, services and industries that are likely to dominate future demand,” explains Dora Buckulčíková, one of three portfolio managers responsible for the previous strategy who will shift to the expanded version.

Grouping megatrends into investable themes further sharpens focus. “We can efficiently steer investment research toward the industries and companies most likely to generate the most growth and returns as megatrends and themes unfold over time. It also helps avoid companies with legacy products and business models that can’t or won’t adapt to constructive (but also disruptive) structural forces,” explains Steef Bergakker, another veteran manager from the previous strategy.

Figure 1 – The underlying pool of investment strategies

For example, robotics and automation, a theme within Transformative Technologies, helps increase the efficiency, productivity and profits across manufacturing, food services, warehousing and even healthcare. Moreover, transformation isn’t limited to developed markets; emerging markets offer substantial opportunities for companies providing leap-frogging digital technologies such as e-commerce, digital payments, and logistics tracking to underbanked and underserviced populations.

Likewise, aging populations, a theme within Changing Sociodemographics, is driving demand for more effective, convenient and cost-efficient healthcare. This benefits companies that provide telemedicine, wearable diagnostic devices, and even well-being and good nutrition among savvy seniors that want to live longer and stronger.

Within Preserving Earth the team draws from companies focused on the energy transition, the circular economy, and smarter input materials. Such investments are enabling and adopting solutions to mitigate climate change, resource scarcity, and loss of biodiversity.

More opportunity, greater diversification

Thematic portfolios, especially pure-plays, are good sources of concentrated growth, but their narrow focus also means more concentrated risks. Marco van Lent, the third manager of the portfolio triumvirate, says the strategy aims to minimize those risks.

“Investing in multiple themes, broadens the sources of return over a much larger base that is diversified across economic sectors, industry value chains, end-market geographies, and even company size.”

The latter is important as larger companies provide return stability to counterbalance the volatility of high-growth stocks.

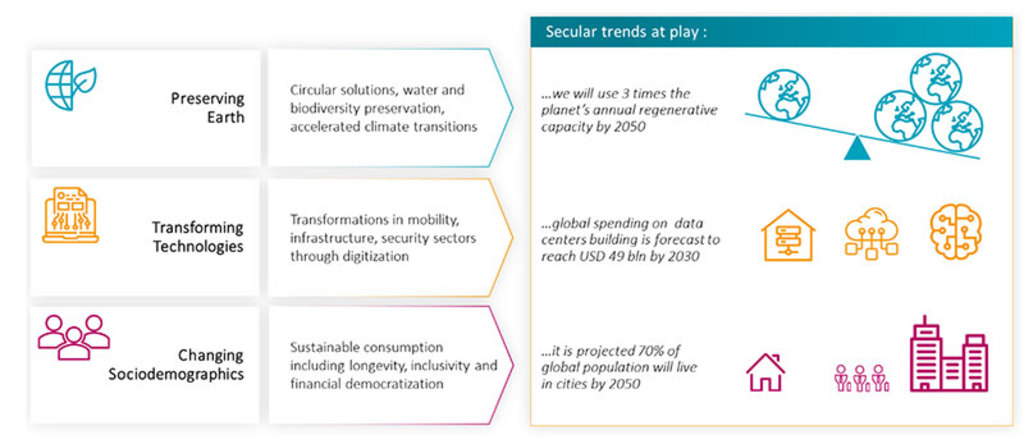

Figure 2 – With megatrends, the future takes shape

Source: Robeco, World Economic Forum, statistics from White and Case. Data accessed in 2024.

Dynamically distilling value

Thematic investing demands acute foresight that is informed by rigorous research often in niche fields and on companies that are under-researched and under-appreciated by broader markets.

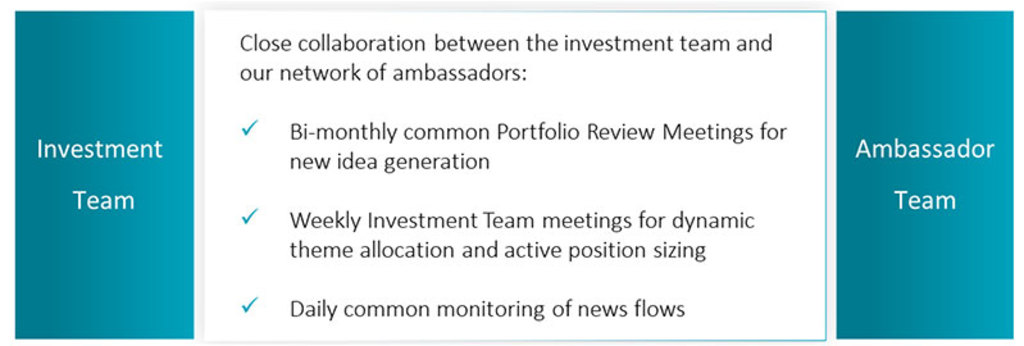

A newly created roundtable of ambassadors, each representing a thematic strategy, helps efficiently channel knowledge and insights to the strategy’s three portfolio managers and two analysts. Bergakker likens the roundtable to a dynamic hub-and-spoke system. “It functions like a centralized command post, where we brainstorm with a brain trust of thematic experts to generate the most promising and timely investment ideas from a full range of multi-dimensional themes.”

“From there we do bottom-up fundamental analysis on individual stocks, which includes a proprietary company life-cycle framework, to ensure we only select companies with the best fit in terms of risk, value and alpha-generation potential.”

Figure 3 – Brainstorming with a brain trust of thematic wisdom

Source: Robeco, 2024.

The result is a diversified portfolio of 60-80 stocks, tilted toward themes best poised for growth and concentrated on companies in the best position to capture it.

Van Lent believes this ability to dynamically calibrate exposure to optimize the overall portfolio’s risk-reward potential may offer an advantage over passive theme products that re-balance less frequently, leaving them vulnerable to portfolio drift.

“Fundamentally, we are long-term investors who take advantage of the significant compounding effects of companies that are gradually increasing profits, expanding market share, and reinvesting through time. But we also want to be nimble enough to scale up or dial back exposure to themes (and companies) based on changing market conditions that could be helpful or hurtful to future growth.”

Leveraging pioneering experience

The strategy leans on a quarter of a century’s worth of experience in systematically identifying and constructing thematic portfolios. Robeco launched its first multi-sector strategy in the late 1990s which was quickly followed by a series of innovative pure-play themes focused on companies helping industries and consumers more efficiently manage their use of natural resources.

Over the past two decades, Robeco’s thematic portfolio has grown to include 13 thematic equity strategies, a remarkable feat given that many thematic strategies close within ten years.2 Buckulčíková says longevity has been key in building and adapting themes through time.

“Solving long-term challenges in business and society is a thread that runs through all of Robeco’s themes.” This pragmatic-approach features largely in the fashion engagement strategy (which Buckulčíková also manages), that launched in 2023 to address the industry’s infamous overproduction and waste issues while also harnessing its growth potential.

A uniquely powerful blend

The Global Multi-Thematic strategy is classified as Article 8 under the Sustainable Finance Disclosure Regulation (SFDR) meaning it intentionally promotes environmental and social characteristics in business and society.

Investment decisions are also supported by 50+ in-house sustainability experts whose ESG risk analytics, SDG impact framework, and award-winning engagement have helped garner the strategy highly competitive Sustainability Ratings.

Bergakker and team agree, “we’ve designed a portfolio that uniquely blends far-ranging expertise with a dynamic investment process to harness thematic momentum and capture the best of a world in progress. That’s a powerful mix that’s hard to match on the market.”

Footnotes

1Robeco MegaTrends, the predecessor strategy, was launched in 2013.

2Morningstar, 24 March 2022. “Thematic Funds Continue to Capture Investors’ Imagination—and Their Money.”

最新のインサイトを受け取る

投資に関する最新情報や専門家の分析を盛り込んだニュースレター(英文)を定期的にお届けします。

重要事項

当資料は情報提供を目的として、Robeco Institutional Asset Management B.V.が作成した英文資料、もしくはその英文資料をロベコ・ジャパン株式会社が翻訳したものです。資料中の個別の金融商品の売買の勧誘や推奨等を目的とするものではありません。記載された情報は十分信頼できるものであると考えておりますが、その正確性、完全性を保証するものではありません。意見や見通しはあくまで作成日における弊社の判断に基づくものであり、今後予告なしに変更されることがあります。運用状況、市場動向、意見等は、過去の一時点あるいは過去の一定期間についてのものであり、過去の実績は将来の運用成果を保証または示唆するものではありません。また、記載された投資方針・戦略等は全ての投資家の皆様に適合するとは限りません。当資料は法律、税務、会計面での助言の提供を意図するものではありません。 ご契約に際しては、必要に応じ専門家にご相談の上、最終的なご判断はお客様ご自身でなさるようお願い致します。 運用を行う資産の評価額は、組入有価証券等の価格、金融市場の相場や金利等の変動、及び組入有価証券の発行体の財務状況による信用力等の影響を受けて変動します。また、外貨建資産に投資する場合は為替変動の影響も受けます。運用によって生じた損益は、全て投資家の皆様に帰属します。したがって投資元本や一定の運用成果が保証されているものではなく、投資元本を上回る損失を被ることがあります。弊社が行う金融商品取引業に係る手数料または報酬は、締結される契約の種類や契約資産額により異なるため、当資料において記載せず別途ご提示させて頂く場合があります。具体的な手数料または報酬の金額・計算方法につきましては弊社担当者へお問合せください。 当資料及び記載されている情報、商品に関する権利は弊社に帰属します。したがって、弊社の書面による同意なくしてその全部もしくは一部を複製またはその他の方法で配布することはご遠慮ください。 商号等: ロベコ・ジャパン株式会社 金融商品取引業者 関東財務局長(金商)第2780号 加入協会: 一般社団法人 日本投資顧問業協会