最新のインサイトを受け取る

投資に関する最新情報や専門家の分析を盛り込んだニュースレター(英文)を定期的にお届けします。

Demand for green bonds has grown spectacularly, reflecting investors’ ambitious climate policies. But can investors accommodate green bonds in their portfolios without causing a shift in risk-return profiles?

Many institutional investors have stated ambitious climate policies for their investment portfolios. Financing the energy transition through investments in green bonds is one of the many routes that investors can take towards the path to net zero. And, indeed, investors’ appetite for these assets is reflected in the tremendous growth in the green bond market in recent years.

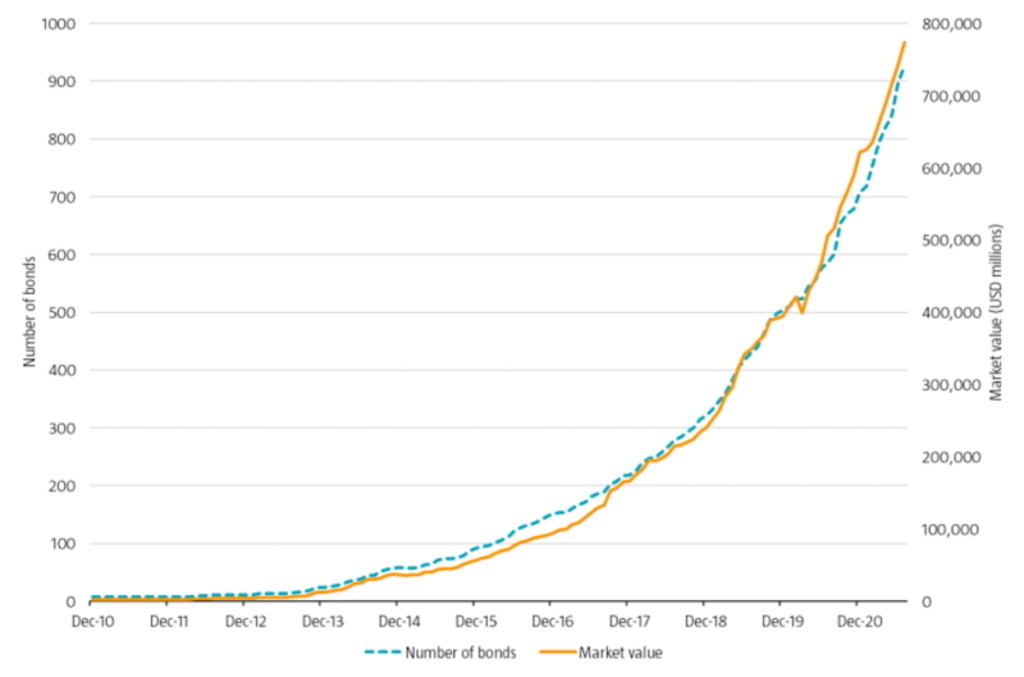

The Green Bond Principles were created in January 2014. At the launch of the green bond index that year in October, the number of qualifying bonds was 55, totaling USD 36 billion in market value. The market has since taken off and has been accelerating in recent years. There were 503 bonds in the index at the end of 2019, increasing to 707 a year later. The market value increased from USD 395 billion to USD 622 billion over the same year.

Despite this rapid growth, green bonds currently account for less than 1% of the global investment grade fixed income market.

Source: ICE BofA Green Bond Index. Index code: GREN. Sample period: 31 December 2010 to 31 July 2021.

In practice, incorporating a growing allocation to green bonds calls for careful portfolio oversight as it could lead to an alteration in the risk and return characteristics of an existing fixed income portfolio.

We researched which fixed income assets investors should sell in order to have the least impact on the risk-return profile of their portfolio (read the academic paper here). Our results robustly indicate that investors should see the current green bond market as a global aggregate portfolio with additional tilts to Eurozone assets and corporate bonds. This is therefore the profile of assets that investors should aim to replace when adding green bonds to a portfolio; such an approach would serve to keep the risk-return profile of the portfolio intact, while substantially improving its sustainability attributes.

投資に関する最新情報や専門家の分析を盛り込んだニュースレター(英文)を定期的にお届けします。

Green bonds are a relatively new financial instrument that may facilitate the energy transition. These instruments can be issued by governments, supranational and government-related institutions or corporate entities. The issuance of green bonds is typically tied to specific green projects designed to avoid or reduce climate change, such as renewable energy projects that facilitate the energy transition away from fossil fuels.

A research question that has not yet been addressed in the academic literature on green bonds is the place of green bond investments in an overall fixed income portfolio. This research question is challenging for two reasons.

Firstly, since the market has seen a rapid development over the past years, historical data may not be representative for future risk and return characteristics. Secondly, the green bond market has different characteristics from a typical fixed income benchmark, as it has a different credit rating, currency, sector, and maturity composition.

Our empirical analysis shows that the green bond market is predominantly a market with bond issues denominated in euro and with less credit risk than a corporate bond portfolio. The sector composition is also tilted to government-related securities and includes emerging markets issuers.

An analysis of the data shows that returns data for green bonds going back to 2010 may not be representative for the future. The number of green bonds was limited in the early days, making idiosyncratic risk much more important in the early part of the sample period. In addition, the composition on the dimensions rating, currency, sector and maturity has changed considerably over time. Using returns data prior to the launch date of the green bonds index in October 2014 is therefore unlikely to help to better understand future risk and return of green bonds.

Using the data from 2014 onwards, we find that a green bond allocation strongly resembles a global aggregate bond portfolio, with a tilt to corporate bonds and euro-denominated assets. While investors could expand existing government bond mandates to now also include green government and government-related bonds, and expand existing corporate bond mandates to also include green corporate bonds, an alternative would be to allocate to a separate green bond strategy run by a specialized manager. The advantage of the latter may be that the investor can better monitor and control the amount invested in green bonds, which may be an important element of its sustainability goals.

Such investors should finance the green bond allocation by selling their aggregate investment grade fixed income portfolio, rather than only government or only corporate bonds. This way, the risk-return profile of the portfolio would be least affected, while the sustainability of their portfolio would be improved by contributing to the energy transition.

当資料は情報提供を目的として、Robeco Institutional Asset Management B.V.が作成した英文資料、もしくはその英文資料をロベコ・ジャパン株式会社が翻訳したものです。資料中の個別の金融商品の売買の勧誘や推奨等を目的とするものではありません。記載された情報は十分信頼できるものであると考えておりますが、その正確性、完全性を保証するものではありません。意見や見通しはあくまで作成日における弊社の判断に基づくものであり、今後予告なしに変更されることがあります。運用状況、市場動向、意見等は、過去の一時点あるいは過去の一定期間についてのものであり、過去の実績は将来の運用成果を保証または示唆するものではありません。また、記載された投資方針・戦略等は全ての投資家の皆様に適合するとは限りません。当資料は法律、税務、会計面での助言の提供を意図するものではありません。 ご契約に際しては、必要に応じ専門家にご相談の上、最終的なご判断はお客様ご自身でなさるようお願い致します。 運用を行う資産の評価額は、組入有価証券等の価格、金融市場の相場や金利等の変動、及び組入有価証券の発行体の財務状況による信用力等の影響を受けて変動します。また、外貨建資産に投資する場合は為替変動の影響も受けます。運用によって生じた損益は、全て投資家の皆様に帰属します。したがって投資元本や一定の運用成果が保証されているものではなく、投資元本を上回る損失を被ることがあります。弊社が行う金融商品取引業に係る手数料または報酬は、締結される契約の種類や契約資産額により異なるため、当資料において記載せず別途ご提示させて頂く場合があります。具体的な手数料または報酬の金額・計算方法につきましては弊社担当者へお問合せください。 当資料及び記載されている情報、商品に関する権利は弊社に帰属します。したがって、弊社の書面による同意なくしてその全部もしくは一部を複製またはその他の方法で配布することはご遠慮ください。 商号等: ロベコ・ジャパン株式会社 金融商品取引業者 関東財務局長(金商)第2780号 加入協会: 一般社団法人 日本投資顧問業協会

重要なお知らせ 当社や当社役職員を装ったSNSアカウントやウェブサイト等を使った投資勧誘にご注意ください さらに表示