Ocean life and hazardous chemicals lead 2024 engagement themes

Two new Robeco engagement themes will target ocean biodiversity and hazardous chemicals, next to efforts to address high-carbon companies and drive the transition to sustainable fashion.

Resumen

- Two new themes will focus on preserving sea life and stopping use of PFAS

- Traffic light system to identify companies lagging in net-zero transition

- Fashion engagement follows launch of investment strategy targeting sector

The topics were selected after consultation with Robeco’s clients as the latest focus engagement themes to launch in 2024. As with all new focus themes, the engagement process for ocean biodiversity and hazardous chemicals will run for three years with selected investee companies.

In addition, enhanced engagement will be stepped up in 2024 with high-carbon companies lagging behind in the net-zero transition, up to and including the risk of exclusion if they don’t meet Robeco’s minimum climate standards by 2026.

Meanwhile, a theme on engagement with the fashion industry that began with the launch of a bespoke investment strategy covering the sector in October 2023 will see its first full year of operation. It is one of only two strategies at Robeco in which the constituents are selected with a view to engaging with all of them to improve their sustainability.

The ocean biodiversity theme will involve engaging with about six companies that have a significant impact on sea life, such as aquaculture and fisheries. Overfishing and the pollution of maritime environments are two of the five main drivers of biodiversity loss.

“Ocean biodiversity is an area within the wider biodiversity theme where we haven’t spent much of our time to date,” says Laura Bosch, Sustainable Investing Specialist who coordinates Robeco’s engagement on biodiversity.

“So far, we have tended to focus on deforestation and our collaboration with Nature Action 100, which has had a strong focus on terrestrial or land use change, and much less so on oceans. We’ll focus on listed companies in aquaculture and fisheries, and look at deep sea mining for the first time.”

Deep sea mining is a contentious arena in which valuable minerals are dredged from the sea bed, threatening ocean life and posing a pollution threat. Much of this work will be carried out with Nature Action 100, a collaborative effort launched in September 2023. The first step will be to send a letter setting out investor expectations to 100 companies likely to become involved in the sector.

Targeting novel entities

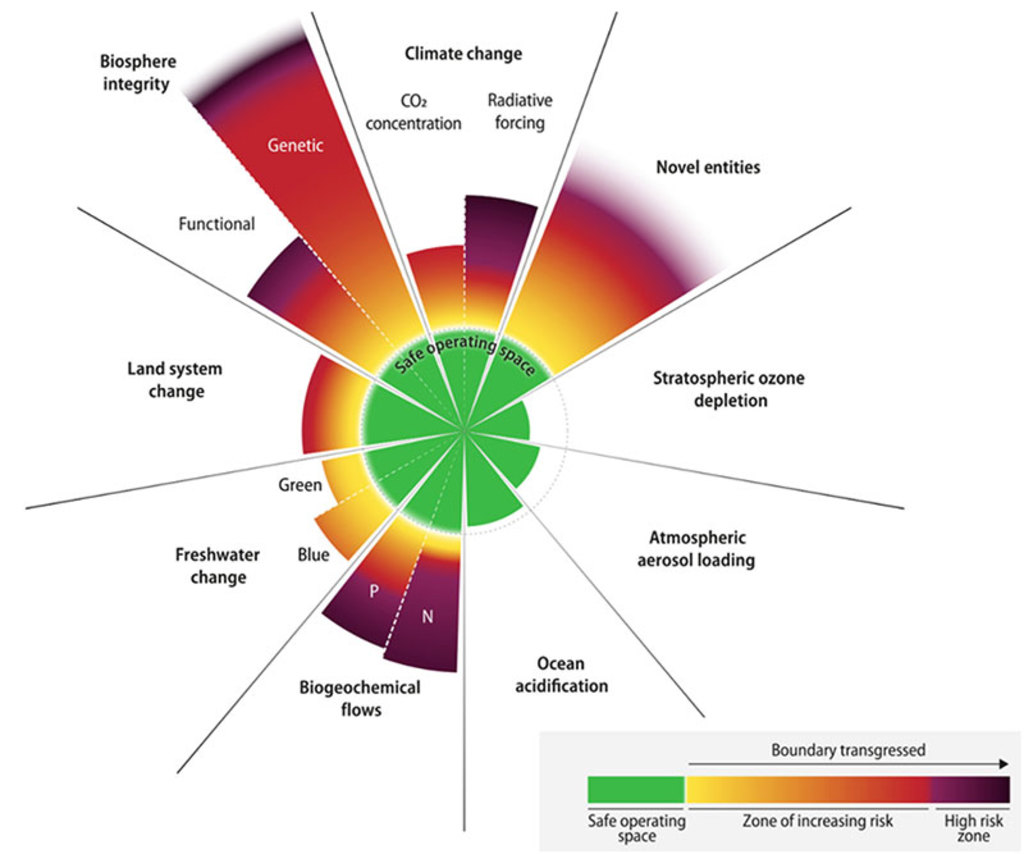

The hazardous chemicals theme will also target about six companies with a view to phasing out their use, particularly PFAS, known as ‘forever chemicals’ because their pollutive capabilities last for thousands of years. The massive increase in their distribution has led to the ‘novel entities’ planetary boundary being significantly breached in 2023, as shown in the chart below.

Novel entities is one of six planetary boundaries that have been breached. Source: Science Advances.1

“Both ocean biodiversity and hazardous chemicals have a focus on the planetary boundaries, which are way out of the safe zone,” says Sylvia van Waveren, Robeco’s Senior Engagement Specialist responsible for dialogue with the chemicals industry.

“The hazardous chemicals theme is being run in conjunction with ChemSec, a Swedish NGO that provides investors with research on it. So, it’s a collaborative engagement.2 We recently signed a letter on the phase-out of hazardous chemicals to 54 companies that ChemSec has in scope. As with ocean biodiversity, we will prioritize the six most important ones for our engagement next year.”

“It’s really about phasing out things like PFAS that can wreak havoc in ecosystems for decades after they have been used. The companies making them need to substitute them with chemicals that are less pollutive, in regular chemical products, in agrochemicals and in different parts of the chemical industry.”

Traffic lights flashing red

The existing ‘Acceleration to Paris’ climate theme will continue, with a greater emphasis in 2024 on speeding up the transition of business models to meet the Paris Agreement temperature goals. Minimum standards will be introduced for 42 companies, with a deadline of 2026 for those in the developed world to meet them, and 2028 for those in emerging markets.

“The enhanced climate theme uses Robeco’s traffic light system of green, light green, amber and red showing where they are in the low-carbon transition,” says Cristina Cedillo, Senior Engagement Specialist responsible for coordinating climate engagement at Robeco. “The whole system covers 146 companies, but it’s the 42 with the red light that are really falling below our minimum standards. We’ve selected about 20% of them to become part of our enhanced Acceleration to Paris engagement program.”

“One of these minimum standards is reporting emissions data for Scope 1 and Scope 2 and subsequently setting targets for emissions reductions, which is vital for the more carbon-intensive sectors.”

“In addition, we expect oil and gas companies to set methane targets, which is something that we don’t have yet. Finally, we also need companies to commit to no new coal expansion. All these criteria are part of our enhanced engagement program, which means that a company could be excluded if we were to conclude our engagement as non-effective.”

Manténgase al día de las novedades en inversión sostenible

Suscríbase a nuestro newsletter para descubrir las tendencias de IS.

Dedicated followers of fashion

The launch of Robeco’s bespoke Fashion Engagement Equities strategy in 2023 led to the issue having its own bespoke theme, and its own team of analysts following it. It was formerly more broadly part of the broader human rights focus as the fashion industry often suffers from dangerous working conditions and poor labor rights for millions of low-paid textiles workers.

The choice of themes follows extensive talks with clients, for whom Robeco manages sustainable investment strategies and also engages with investee companies on their behalf. “We listened to our clients, and that’s why we’ve changed our approach,” says Peter van der Werf, Head of Engagement.

“Clients tend to cite climate change as their number one topic for engagement, so we’ve decided to assign more engagement capacity on this core engagement theme and its related topics. We used to do a deep dive on a peer group of companies, put them into an engagement theme, and then end the themes at the same time. Now we’re really planning to add companies on a rolling basis when our investment and sustainability research indicates the need for engagement.”

“So, we’ll continue with what we call our ‘evergreen’ engagement themes of climate, biodiversity, human rights and governances. “It’s all an ongoing process, but with a focus on engaging where the most urgent issues will arise for companies in our strategies next year.”