New multi-thematic strategy provides a one-stop shop to a world of opportunities

The latest strategy captures the very best of Robeco’s thematic investing, expanding exposure to even more themes while diversifying risks. More broadly, investors gain early access to the forces shaping tomorrow, carefully curated into one portfolio.

Zusammenfassung

- Exposure to more attractive themes while reducing concentration risks

- Leverages a wealth of pioneering thematic research and SI analytics

- Systemically distils a universe of insights into a single portfolio

The Global Multi-Thematic strategy builds on the foundations of an existing strategy distinguished by more than a decade of successfully investing in evolving themes and structural change. 1 The new strategy will now cover all of Robeco’s pure-play thematic strategies opening access to a diverse range of global equities. It also features a re-tooled investment process to efficiently distill the ‘best- of’ thematic stocks from a significantly expanded universe.

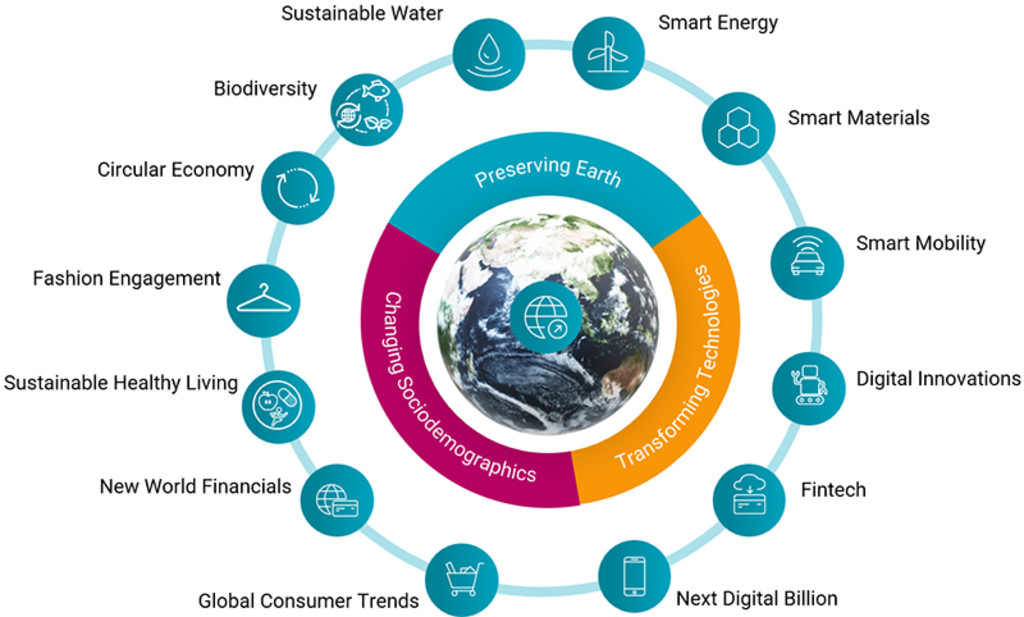

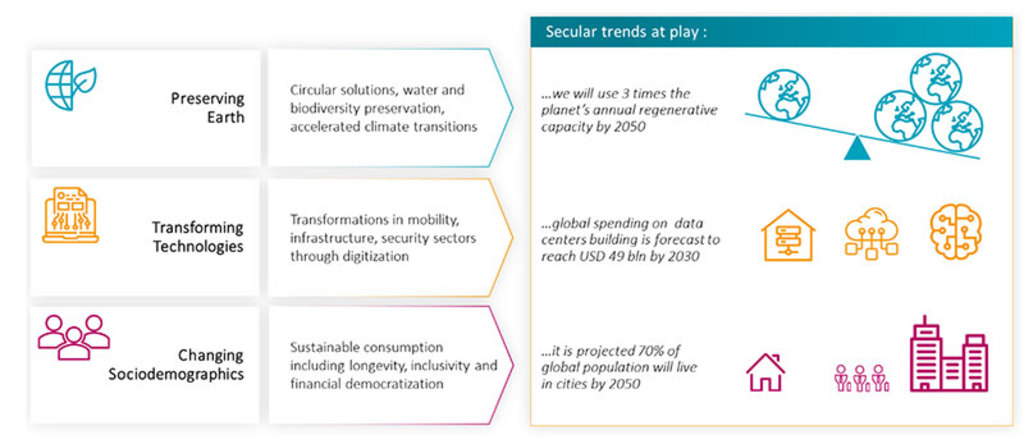

The investment process centers on three megatrends – Preserving Earth, Transforming Technologies, and Changing Sociodemographics – which the team believes are driving substantial opportunities for innovation and long-term returns. “The future takes shape through the lens of megatrends. We observe and anticipate their evolution in business and society and build scenarios for the types of products, services and industries that are likely to dominate future demand,” explains Dora Buckulčíková, one of three portfolio managers responsible for the previous strategy who will shift to the expanded version.

Grouping megatrends into investable themes further sharpens focus. “We can efficiently steer investment research toward the industries and companies most likely to generate the most growth and returns as megatrends and themes unfold over time. It also helps avoid companies with legacy products and business models that can’t or won’t adapt to constructive (but also disruptive) structural forces,” explains Steef Bergakker, another veteran manager from the previous strategy.

Figure 1 – The underlying pool of investment strategies

For example, robotics and automation, a theme within Transformative Technologies, helps increase the efficiency, productivity and profits across manufacturing, food services, warehousing and even healthcare. Moreover, transformation isn’t limited to developed markets; emerging markets offer substantial opportunities for companies providing leap-frogging digital technologies such as e-commerce, digital payments, and logistics tracking to underbanked and underserviced populations.

Likewise, aging populations, a theme within Changing Sociodemographics, is driving demand for more effective, convenient and cost-efficient healthcare. This benefits companies that provide telemedicine, wearable diagnostic devices, and even well-being and good nutrition among savvy seniors that want to live longer and stronger.

Within Preserving Earth the team draws from companies focused on the energy transition, the circular economy, and smarter input materials. Such investments are enabling and adopting solutions to mitigate climate change, resource scarcity, and loss of biodiversity.

Global Multi-Thematic

Zentrale Anlaufstelle für das „Best of Thematic Investing“ bei Robeco

More opportunity, greater diversification

Thematic portfolios, especially pure-plays, are good sources of concentrated growth, but their narrow focus also means more concentrated risks. Marco van Lent, the third manager of the portfolio triumvirate, says the strategy aims to minimize those risks.

“Investing in multiple themes, broadens the sources of return over a much larger base that is diversified across economic sectors, industry value chains, end-market geographies, and even company size.”

The latter is important as larger companies provide return stability to counterbalance the volatility of high-growth stocks.

Figure 2 – With megatrends, the future takes shape

Source: Robeco, World Economic Forum, statistics from White and Case. Data accessed in 2024.

Dynamically distilling value

Thematic investing demands acute foresight that is informed by rigorous research often in niche fields and on companies that are under-researched and under-appreciated by broader markets.

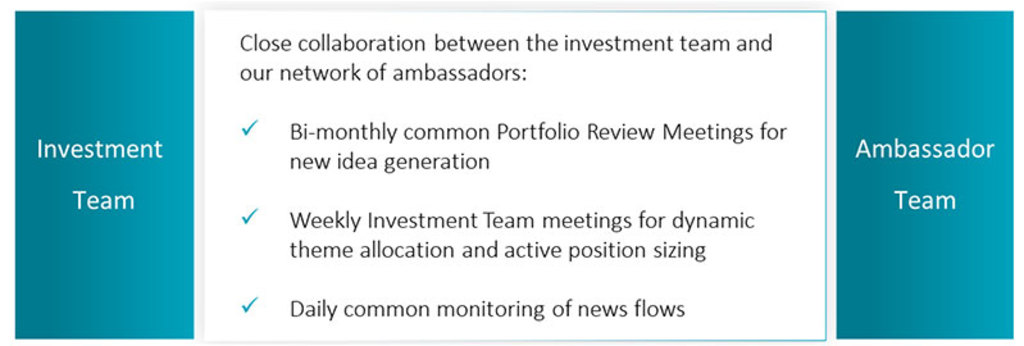

A newly created roundtable of ambassadors, each representing a thematic strategy, helps efficiently channel knowledge and insights to the strategy’s three portfolio managers and two analysts. Bergakker likens the roundtable to a dynamic hub-and-spoke system. “It functions like a centralized command post, where we brainstorm with a brain trust of thematic experts to generate the most promising and timely investment ideas from a full range of multi-dimensional themes.”

“From there we do bottom-up fundamental analysis on individual stocks, which includes a proprietary company life-cycle framework, to ensure we only select companies with the best fit in terms of risk, value and alpha-generation potential.”

Figure 3 – Brainstorming with a brain trust of thematic wisdom

Source: Robeco, 2024.

The result is a diversified portfolio of 60-80 stocks, tilted toward themes best poised for growth and concentrated on companies in the best position to capture it.

Van Lent believes this ability to dynamically calibrate exposure to optimize the overall portfolio’s risk-reward potential may offer an advantage over passive theme products that re-balance less frequently, leaving them vulnerable to portfolio drift.

“Fundamentally, we are long-term investors who take advantage of the significant compounding effects of companies that are gradually increasing profits, expanding market share, and reinvesting through time. But we also want to be nimble enough to scale up or dial back exposure to themes (and companies) based on changing market conditions that could be helpful or hurtful to future growth.”

Leveraging pioneering experience

The strategy leans on a quarter of a century’s worth of experience in systematically identifying and constructing thematic portfolios. Robeco launched its first multi-sector strategy in the late 1990s which was quickly followed by a series of innovative pure-play themes focused on companies helping industries and consumers more efficiently manage their use of natural resources.

Over the past two decades, Robeco’s thematic portfolio has grown to include 13 thematic equity strategies, a remarkable feat given that many thematic strategies close within ten years.2 Buckulčíková says longevity has been key in building and adapting themes through time.

“Solving long-term challenges in business and society is a thread that runs through all of Robeco’s themes.” This pragmatic-approach features largely in the fashion engagement strategy (which Buckulčíková also manages), that launched in 2023 to address the industry’s infamous overproduction and waste issues while also harnessing its growth potential.

A uniquely powerful blend

The Global Multi-Thematic strategy is classified as Article 8 under the Sustainable Finance Disclosure Regulation (SFDR) meaning it intentionally promotes environmental and social characteristics in business and society.

Investment decisions are also supported by 50+ in-house sustainability experts whose ESG risk analytics, SDG impact framework, and award-winning engagement have helped garner the strategy highly competitive Sustainability Ratings.

Bergakker and team agree, “we’ve designed a portfolio that uniquely blends far-ranging expertise with a dynamic investment process to harness thematic momentum and capture the best of a world in progress. That’s a powerful mix that’s hard to match on the market.”

Footnotes

1Robeco MegaTrends, the predecessor strategy, was launched in 2013.

2Morningstar, 24 March 2022. “Thematic Funds Continue to Capture Investors’ Imagination—and Their Money.”

Holen Sie sich die neuesten Einblicke

Abonnieren Sie unseren Newsletter, um aktuelle Anlageinformationen und Analysen durch Sachverständige zu erhalten.